The world is witnessing the carnage of the novel coronavirus (COVID-19) pandemic. There has been a significant loss of human lives and the global economy has also felt the impact severely. Global markets are in a free fall with supply-chain disruption and manufacturing falling to the lowest levels in decades. Despite disturbances in the global economy, India was among the brighter spots till last month in terms of exports and manufacturing, with the Directorate General of Foreign Trade (DGFT) and Purchasing Managers’ Index (PMI) numbers coming in strong for February 2020. But our markets are not that insulated from global headwinds any longer, nor from the COVID-19 pandemic. Indian benchmark indices, i.e., the Sensex and Nifty, are down by about 35-40% in a matter of less than 30 trading sessions. Further, the Indian government has imposed a lockdown of 21 days and brought major economic activities to a grinding halt.

This working series is a three-part analysis of Indian exports, particularly in terms of the current tumultuous scenario and the likely expected impact on global trade in the coming months. This is the first part of the series analysing the impact on trade through various macroeconomic factors.

Teetering on the Edge of Another Global Recession

A few weeks ago, global venture capital firm Sequoia Capital sent out a memo to its portfolio CEOs and founders, titled Corona Virus - The Black Swan of 2020. Back in 2008, Sequoia Capital had sounded similar alarm bells with a presentation R.I.P. Good Times. They are not alone in calling this situation an onset of another recession.

Financial heavyweights, including Goldman Sachs, Morgan Stanley and Bank of America, to name a few, are painting a grim picture of tough quarters ahead. The commentary seems to be pointing towards a recession as a base case, and it could get worse. The International Monetary Fund (IMF) has projected negative growth for 2020 with a likely recovery in 2021, subject to containment of the virus.

The world has seen its share of recessions and the last two decades have notoriously changed the rules of classical economics. Yet, the fundamentals around the role of supply and demand as the driver of economies remain constant. The global financial crash of 2008 is a classic example of an oversupplied market, where the demand was driven up until there was none.

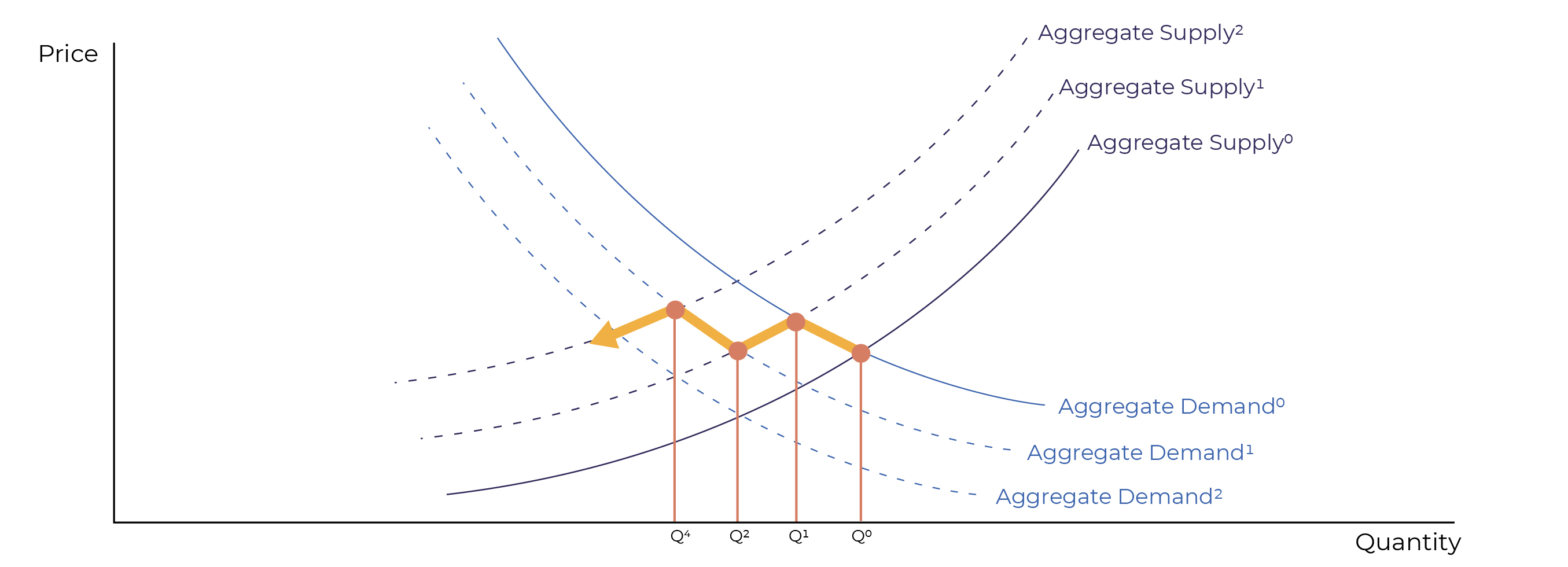

The looming crisis on our hands is particularly worrisome as it poses a dual demand and supply shock to the global economy. The disruption in global supply chains, and lockdowns instituted by various governments reducing the supply of human resources, are bound to provide an initial supply shock. As more and more countries face lockdowns, demand will start plummeting. This, in addition, impacts the supply as low liquidity forces firms to shut businesses or declare bankruptcy. The potential layoffs will drive lower consumption, thereby depressing demand further. This has been aptly summed up as a ‘__feedback loop between aggregate supply and demand__’ by two professors -- Andrea Galeotti and Paolo Surico from the London Business School.

Fig: Aggregate demand and supply depressing the economic growth through a feedback loop.

Fig: Aggregate demand and supply depressing the economic growth through a feedback loop.

This problem is further aggravated by the developing nature of the pandemic and ever-changing epicentres. What started off in China, in recent weeks has shifted to Iran, then to Europe and currently is centred in the United States. While China has recovered from the horrors of the pandemic and is now ready to start exporting, it might not find many buyers for all commodities in the market as other countries fend off the virus, shut their borders and isolate citizens.

What Happens When the Tide Goes Out

“Only when the tide goes out do you discover who's been swimming naked.” ― Warren Buffett

With the current focus of governments across the globe remains on containing the spread of the virus, economic tremors are likely to be felt in the coming months. Depending on the proactive measures of respective governments, the economic impact of the pandemic is going to be either cushioned or compounded.

Global trade is a key victim of this outbreak, with the potential for widespread economic mayhem. Factors like supply chain disruption, demand shock and the looming recession are bound to impact international trade even further, which is still recovering from the recent trade wars. India has emerged as a major exporting nation in recent years and this pandemic is bound to set back India’s ambitious export targets. As per a United Nations Conference on Trade and Development (UNCTAD) report, a 1% decline in GDP growth of the world leads to around 1.88% decline in Indian exports to the world.

How Sick Is Our Economy?

Ever since liberalisation in 1991, India has been more interconnected with the global economy than ever. In the 30 years since then, India has been counted among the rising stars of global emerging economies. With a consistent growth of over 6% in the last decade or so, fueled by business-friendly policies, India has been among the key drivers of global economic growth.

As a major player in the global economic ecosystem, India has been able to weather previous global crises -- the SARS, MERS and H1N1 outbreaks, and the 2008 financial crisis -- rather comfortably. The following graphs indicate the movement of major economic parameters during these crises. In them, it can be clearly seen that while the 2003 SARS crisis was similar in nature to the current COVID-19 pandemic, when the early phases of both are compared, the economic impact then was nowhere near to the crisis at hand. In fact, the current pandemic is behaving more like the global financial crisis of 2008 in terms of the economic factors.

Fig: Economic Indicators during SARS Pandemic (2003)

Fig: Economic Indicators during SARS Pandemic (2003)

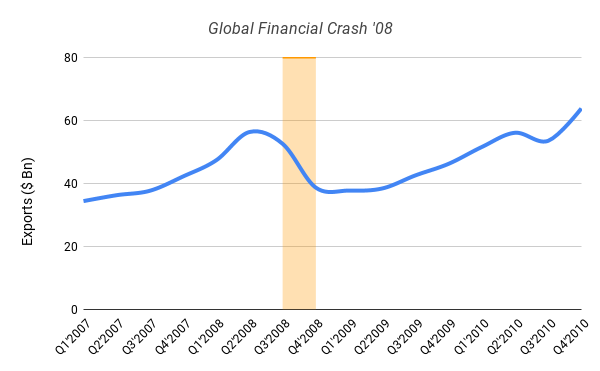

Fig: Economic Indicators during Global Financial Crash (2008)

Fig: Economic Indicators during Global Financial Crash (2008)

Fig: Economic Indicators during COVID Pandemic (2020)

Fig: Economic Indicators during COVID Pandemic (2020)

With India’s Gross Domestic Product (GDP) forecasts cut to as low as sub-2.5% by Moody’s, the current state of affairs has been correctly pronounced by many economists as a ‘__Minsky Moment__’ -- exhibiting a sudden, major collapse of asset values marking an end to the growth phase of the economy. With these clear headwinds, Indian exports are also likely to get impacted and remain subdued in the coming months.

Recovery in Time for Christmas?

Indian exports were already reeling under some stress in the last financial year, with a best-case scenario exhibiting at-par performance with the previous financial year. Due to the outbreak of COVID-19, March export numbers are evidently trending to be lower by easily between 15-20% as per our internal estimates. These export numbers are likely to contract further in the coming months, with reports of order cancellations from major markets like the US and Europe. This along with a halt in manufacturing due to the current lockdown is bound to depress exports during the whole of Q2-2020, spilling over to Q3-2020.

Fig: Indian Exports between 2007 - 2010

Fig: Indian Exports between 2007 - 2010

During the global financial crisis of 2008 too, Indian exports largely suffered owing to subdued overseas demand. As seen clearly in the figure above, it took around 12 months for Indian exports to attain a level equivalent to the pre-crisis months, and around 18 months to attain a similar trajectory of growth in terms of month-over-month growth rate. Given the current parallels to 2008, we can thus estimate the probable recovery time for Indian exports to get back on track.

On the other hand, Sajjid Chinoy, Chief India Economist, JP Morgan has stated recently in an interview that while the next quarters are seemingly difficult, we can expect an equally sharp rebound once the threat of the virus passes over. This commentary could stand true for indian exports as well.

In our opinion, we can expect some signs of recovery in India’s exports by Q4-2020. In a recent commentary piece in The Economic Times, we stated that policy paralysis could negatively impact Indian exports in the immediate future, as will the global trade slowdown. However, as global economies start to stabilize in the medium- to long-term, the following key factors could be helpful in driving the recovery of Indian exports:

- Christmas/Holiday season in the US and the EU has historically driven demand in these geographies, which might provide a positive stimulus to Indian exports

- A weak rupee against the dollar could very well give a short boost to Indian exports, once global trade gets back on track

- India’s export market is interconnected with global value chains more than ever, with India being a leading exporter in agricultural and other essential commodities such as pharmaceuticals which will be in demand during and in the aftermath of the pandemic

Other factors including historically low crude oil prices and lowest ever lending rates by the Reserve Bank of India (RBI) could further aid this growth in future quarters. Saurabh Mukherjea, Founder & CIO, Marcellus Investments Managers, in his recent blog, has tried to point towards a silver lining amidst this gloom. He draws a correlation with all the instances where a fall in global oil prices, lower US government 10-year bond yields and a contraction in the US economy happened simultaneously. These instances have always been followed by a strong economic recovery in India. Based on Mukherjea’s analysis, there is still hope for a recovery for Indian exports in the coming months. However, the ecosystem needs to brace itself for tough times before that happens.

Not Out of the Woods Yet

The next few months remain critical for the Indian economy as a whole. There is an urgent set of policy measures which need to be executed with surgical precision by the government and regulators such as the RBI. Both the Ministry of Finance and the RBI in the past week have announced a slew of steps to battle the economic impact of this pandemic at both the micro and macro levels. These measures might provide some relief on a short term basis, but the policymakers need to start working towards a strategy for the longer term, as India comes out of the lockdown into a “new” world in the aftermath of this pandemic.

The Monetary Policy Committee (MPC) in its most recent announcement delivered an extraordinary cut in the repo rate by 75 basis points along with some relaxation in the (Cash Reserve Ratio) CRR norms to boost liquidity in the market. It also declared a three-month moratorium on existing loan payments. While this might have provided some cheer for the markets, one needs to be cognizant of possible scenarios three months down the line. The enhanced liquidity along with the lockdown may cause a significant peak in inflation in the coming months. There are already reports of trouble in harvesting wheat and interstate transportation of goods. The central bank also needs to prepare for a possible bunching up of loans at the end of the lockdown, once manufacturing and other activities resume.

The exporter community particularly will need some handholding to wade through these troubled times. Incentives like easier pre- and post-shipment credit, relaxation of duties, and support in increasing market access remain key pointers that need to be quickly acted upon. Most importantly, the new Foreign Trade Policy (FTP) needs to be revised and adjusted as per the current state of affairs. In the next part of this series, we explore the impact of this pandemic on various geographies and trade channels from an Indian exports’ context along with expectations from the new FTP in light of these happenings.

Research & Analysis: Pranjal Dubey, Associate, Research (pranjal@dripcapital.com)

For media-related queries, contact: corporatecommunications@dripcapital.com.

You can download Part I here.

DISCLAIMER

This document is issued by Drip Capital as part of a working paper series for general reference and guidance on matters of interest. This document is produced for information purposes only. Drip Capital assumes no responsibility for errors or omissions in the contents of the document. In no event shall Drip Capital be liable for any special, direct, indirect, consequential, or incidental damages or any damages whatsoever, whether in an action of contract, negligence or other tort, arising out of or in connection with the use of the document or the contents of the document. Drip Capital reserves the right to make additions, deletions, or modifications to the contents of the document at any time without prior notice. Although Drip Capital has taken every precaution to ensure that the content of the document is both current and accurate, there could be a possibility of an error. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in the information contained in the document. All information in the document is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. Drip Capital will not be liable to anyone for any decision made or action taken in reliance on the information given by the document or for any consequential, special or similar damages, even if advised of the possibility of such damages.

The document may contain links to external websites that are not provided or maintained by or in any way affiliated with Drip Capital. Please note that Drip Capital does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Drip Capital is not responsible for any errors or omissions, or for the results obtained from the use of this information.

The document may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other author, agency, organization, employer or company, including Drip Capital. In no event shall Drip Capital or its owners be liable for any special, incidental, indirect, or consequential damages whatsoever arising out of or in connection with your access or use or inability to access or use the document.