The non-availability or shortage of timely funds is a common phenomenon in businesses, the reasons of which can be manifold-- from deferred payments to their slow growth. Moreover, organizations are often unable to take up new projects due to financial crunch and get trapped in a vicious cycle, thus leading to their downfall.

Fortunately, the situation can be mitigated up to a great extent by employing various financial instruments. A bank guarantee is one such arrangement that companies can use to temporarily cover for the lack of credit.

What is a Bank Guarantee?

A bank guarantee is a financial instrument wherein a bank acts as the guarantor of the liabilities undertaken by the borrower/applicant. In other words, the bank agrees to pay the amount in case the borrower is not able to fulfil the conditions of the agreement.

Who can Issue a Bank Guarantee? / Where can I Get a Bank Guarantee?

All the leading banks, non-banking financial companies (NBFCs) as well as lending institutions are authorized to issue a bank guarantee.

Why is a Bank Guarantee Required?

A bank guarantee perform two important functions:-

1. Provide immediate credit

A bank guarantee plays a vital role in situations wherein an entrepreneur is not able to secure enough funds to undertake a project and hence seeks credit based on his/her previous financials. With the help of a bank guarantee, the entrepreneur can start the project without having to invest upfront and pay later once the funds arrive.

2. Bridge the trust gap

Generally, it is difficult for a seller to trust a stranger who asks to purchase the goods but pays the amount at a later date. This trust deficit is often the reason for many trade deals falling through. With a bank guarantee from a trustworthy lending institution, the seller can now assuredly crack the deal. Even if the borrower does not make timely payments, the guarantee of the payment is now taken by the bank.

Bank Guarantee Procedure

The process of obtaining a bank guarantee is simple since all the leading banks and lending financial institutions provide this facility. Moreover, you are more likely to receive a bank guarantee from a bank where you already have an account or conduct regular transactions of any kind.

Although companies as well as individuals can both apply and receive bank guarantees, it is common to see businesses opt for it since they are always dealing with situations where such financial instruments come in handy.

To apply for a bank guarantee, you can physically approach the bank, talk to its representative about your requirements or do so online if such a facility exists. They will then ask you to fill up a form wherein you will have to provide details such as the nature of the guarantee like the time duration as well as conditions in which it can be invoked etc. The time duration can be from three months to 10 years, whereas the conditions depend on the nature of the contract. We will talk about the different types of bank guarantees along with their respective terms and conditions further in this article.

Your bank may ask you to provide collateral in exchange for the bank guarantee. In many cases, banks also issue guarantees based on your fixed deposits, mutual funds, stocks, etc.

How does a Bank Guarantee Work?

Once the bank issues a bank guarantee, it is forwarded to the seller after which he/she proceeds to complete the trade without any upfront payment. The guarantee also defines the time period within which the buyer has to pay the seller. Once that is done, the bank guarantee becomes null and void.

In the event of non-payment by the buyer within the stipulated time frame, the seller invokes the bank guarantee and the bank is liable to pay the seller.

We will explain this better with the help of an example.

Suppose ‘company X’ manufactures apparels and receives a huge order. However, they lack the adequate resources to purchase enough raw materials to fulfill this order due to the pending payments from the previous orders.

Now, there is a ‘company Y’ that sells the raw materials that ‘company X’ requires. But they are hesitant to do business without any upfront payment and cannot merely rely on ‘company X’s’ word. So, ‘company X’ decides to apply for a bank guarantee from a bank for the total amount of the trade. The bank, upon taking a look at ‘company X’s’ financials and collateral, approves the guarantee and provides it to ‘company Y.’

This bank guarantee issued to ‘company Y’ means that if the buyer, i.e. ‘company X’ is unable to complete the payment within the stipulated time frame as stated in the document, the bank that has issued the guarantee will pay the seller.

Once ‘company Y’ receives the guarantee, it will proceed to complete the trade and supply the raw materials to ‘company X’ who then begins manufacturing the goods for the order. At a later date, within the stipulated time frame, ‘company X’ makes the required payment directly to ‘company Y.’ The bank guarantee then becomes null and void.

Documents Required for a Bank Guarantee

If you hold a current account with a bank, you need to furnish the following documents to apply for a bank guarantee:-

- An application form

- A bank guarantee letter

- A Stamp paper (as per the State Stamp Act)

- A resolution passed by the board of members in case of a public/private limited company

Bank Guarantee Charges

Banks normally charge 0.50% to 0.75% quarterly on the total amount. However, these charges vary depending on the risk that the lender undertakes. So, the charges on a bank guarantee issued without collateral will be higher as compared to those issued in exchange of collateral. Additional charges include 18% GST that is levied on all banking services, and other charges like processing fees, documentation fees, handling fees, etc.

Bank Guarantee Formats

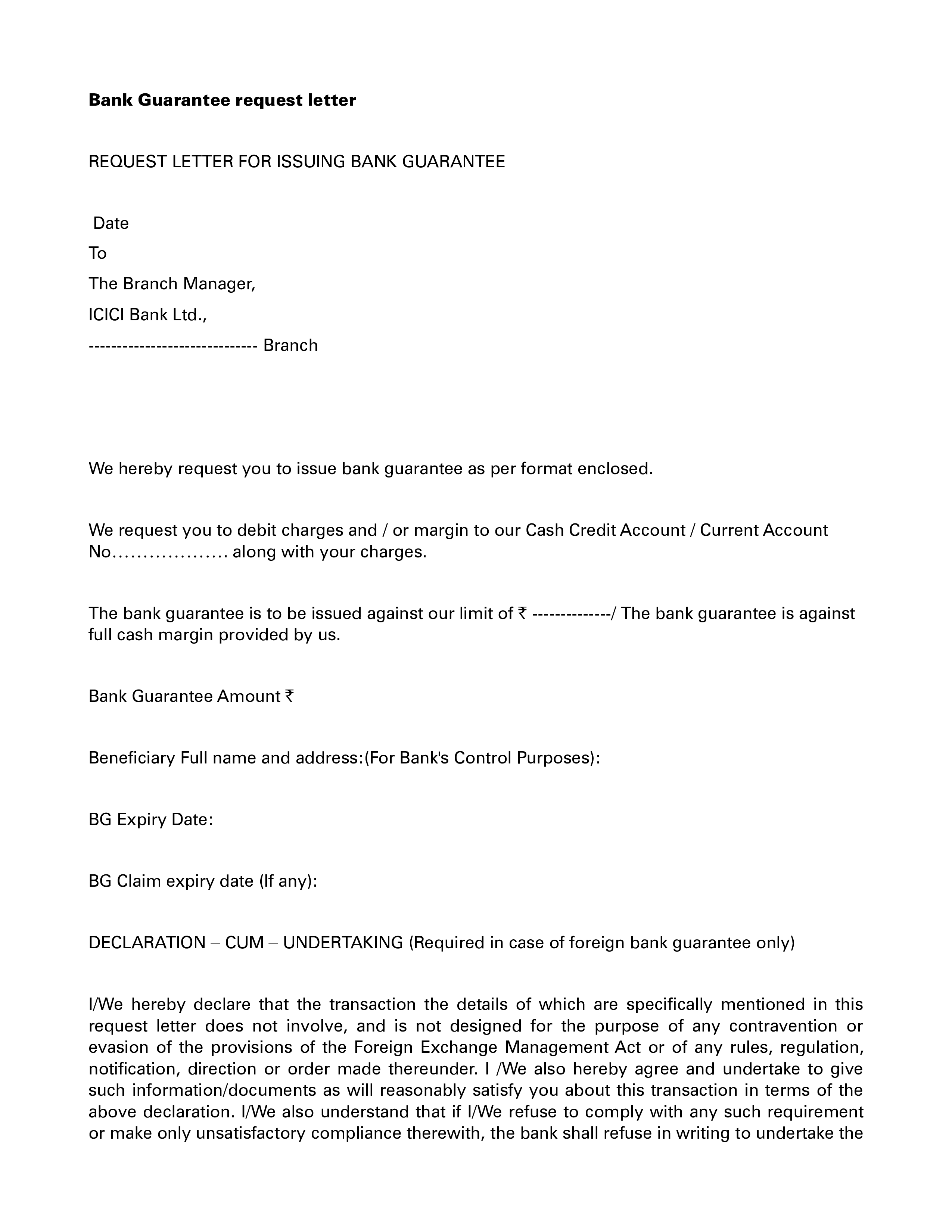

Format of request letter for issuance of bank guarantee

![Format of request letter for issuance of bank guarantee]()

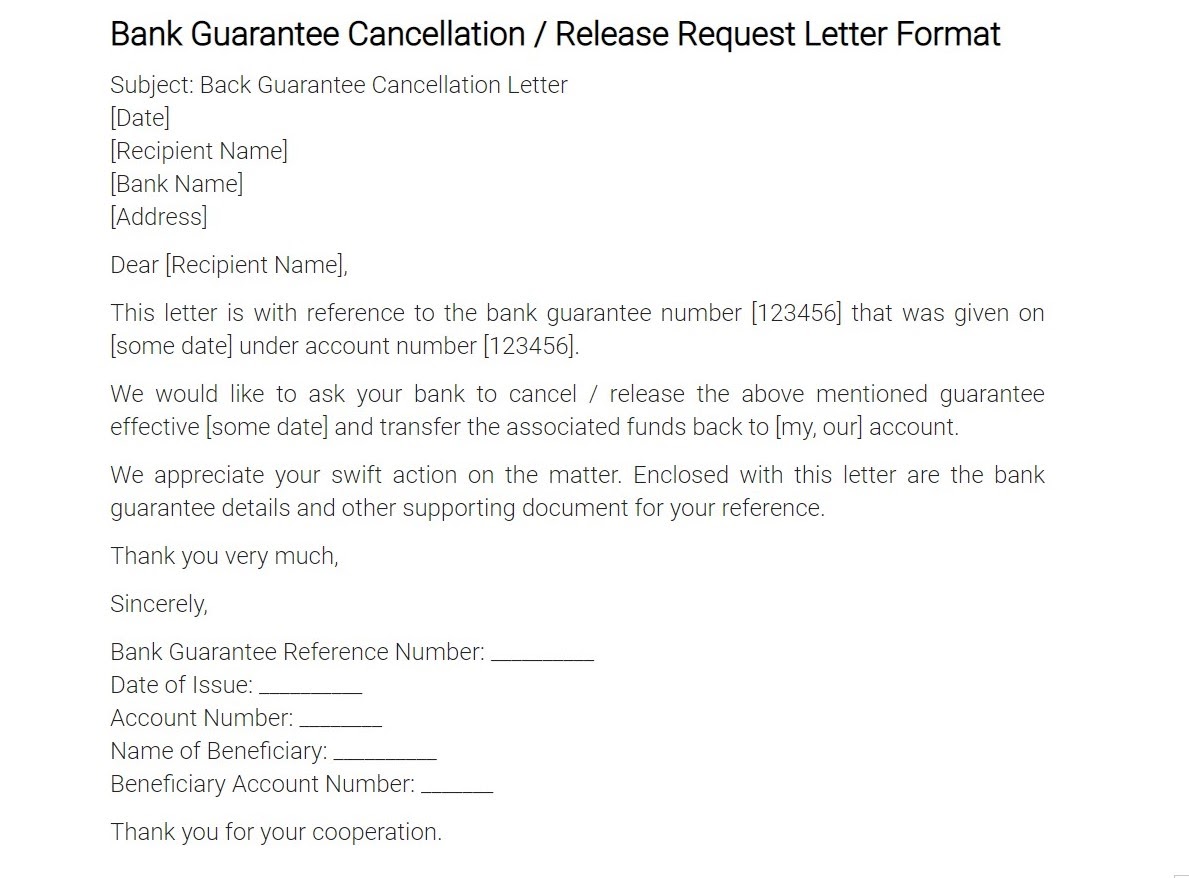

Format of bank guarantee cancellation letter

- Format of bank guarantee for faithful performance of contract

Types of Bank Guarantee

There are several types of bank guarantees. You may apply for the one that best suits your requirements. Some of the most popular types of bank guarantees have been explained below.

Deferred payment guarantee

A deferred payment guarantee is the most common type of bank guarantee. Here, if the buyer fails to pay within the duration that is agreed upon by both parties, the bank takes the liability of paying the seller for the goods/services. Under the deferred payment guarantee, the bank makes the payment to the seller in installments in the event of non-payment by the buyer.

Financial guarantee

A financial guarantee is used in situations when a company promises to complete a project within a particular timeframe and receives funds for the same. The financial guarantee from a bank states that the money will be returned to the client if the company is not able to finish the project within the stipulated time frame.

Advance payment guarantee

Under the advance payment guarantee, the buyer makes an advance payment to the seller. However, this amount is refunded by the bank in case the seller fails to deliver the goods as per the contract terms.

Foreign bank guarantee

A foreign bank guarantee is used in international trade deals. While most bank guarantees involve only one bank, a foreign bank guarantee may involve two banks-- one from each country.

Performance guarantee

A performance guarantee means that the bank will provide compensation to the buyer or recipient of the services if the goods/services are of inferior quality and don’t meet the standards that have been mutually agreed upon by both the parties.

Bid bond guarantee

Bid bond guarantees are used during the bidding process for a project. When any project is up for bidding, multiple contractors compete to win it. The company or the institution awarding the project asks for a bid bond guarantee from all the bidders. This guarantee means that if the bid is accepted, the contractor will take up the project and execute it as per the required standards.

If a contractor is awarded the project but is unable to take it up, the guarantee is evoked by the company and the bank makes the payment. The amount of a bid bond guarantee is generally 5-10% of the estimated project cost.

Advantages and Disadvantages of a Bank Guarantee

Advantages

A bank guarantee is mostly issued against collaterals or securities. Hence they have marginal charges as compared to the other lending instruments.

The process of obtaining a bank guarantee is simple and can be completed quickly. This proves useful to those businesses that require urgent credit.

For the seller, a bank guarantee substantially brings down the risk involved in trade and bridges the trust gap between both parties.

Issuance of a bank guarantee to your name is proof of your good financial records, and can be instrumental in establishing credibility and attracting more businesses.

Disadvantages

A bank guarantee is mostly issued against collaterals or securities. This may create problems for those who do not own substantial assets.

Newly established companies or startups who do not have adequate financial history that banks can assess may find it difficult to obtain bank guarantees.

Banks do not generally approve guarantees for companies that are incurring losses. Such organizations have to opt for other credit instruments that have higher charges.

The Difference between Bank guarantee and Other terms

Letter of credit

An LC is a financial instrument most commonly used in international trade. Here, the buyer’s bank pledges to pay the seller’s bank for the trade conducted. Whereas, in a bank guarantee, the bank agrees to pay the beneficiary in case the applicant fails to pay within the stipulated time period.

Banks have a lesser risk in providing LCs than they do issuing a bank guarantee.

Also Read: Types of Letter of credit

Performance bond

The biggest difference between a bank guarantee and a performance bond is that a bank guarantee is an assurance given by the bank to pay the beneficiary. Whereas, a performance bond is an assurance given by an institution to compensate the beneficiary for their losses due to faulty products or services provided by the applicant.

Corporate Guarantee

A corporate guarantee is an agreement that states that the issuing corporate company is liable to clear all its debts to the recipient company in the event of the former declaring bankruptcy. In a bank guarantee, the bank is liable to clear the payments on behalf of the applicant.

Standby Letter of Credit

An SBLC is a type of LC where the buyer’s bank will pay the seller in case the buyer is unable to pay. A bank guarantee covers only financial risks like the failure to deliver goods on time, etc. An SBLC, on the other hand, is much more holistic in the sense that it covers a variety of financial and non-financial risks. Another difference between the two is that with a bank guarantee, there is only one bank involved, whereas there are multiple banks involved in an SBLC.

Rules and Regulations for a Bank Guarantee

The Indian government has released a circular to its different departments wherein it has laid down the following guidelines for banks that provide bank guarantees.

The officers signing the guarantees should also provide other details such as their name, designation, as well as, their employment codes, below their signature. This will help verify the bank guarantees faster.

Once the beneficiary receives the bank guarantee, they are advised to check its authenticity by contacting the approver’s bank(s).

The initial period of the bank guarantee shall be six months which starts after the original delivery period. An automatic extension of six months can be provided by the banks if they wish to do so by adding a clause in the agreement.

If the applicant fails to adhere to the agreement and does not deliver the goods/ services on time, the bank guarantee will automatically get extended based on the request for an extension of the delivery period.

The bank guarantees used as collateral in the Directorate General of Supplies and Disposal contract administration, as well as, extension letters should be on non-judicial stamp papers.

Apart from these, some general guidelines for banks while issuing bank guarantees are as follows:-

Generally, a bank guarantee should not be awarded for more than 10 years. However, banks may make an exception to this after carefully considering the applicant’s asset performance and financial management.

While bank guarantees can be of two types- finance guarantee and performance guarantee, banks are advised to approve financial guarantees in most cases, and performance guarantees selectively.

Since banks deal with liquidity, they are advised to approve guarantees that mature quickly while the NBFCs can approve guarantees for longer maturity periods.

FAQs on Bank Guarantee

What is a bank guarantee?

A bank guarantee is a contract wherein the bank pledges to make payment on behalf of the borrower in case the borrower fails to conclude the trade as agreed upon by both parties.

When is a bank guarantee required?

Bank guarantees are required when there is a shortage of funds or the lack of trust between the two parties.

Is a bank guarantee refundable?

As soon as the applicant pays his/her dues to the seller within the stipulated time frame, the bank guarantee becomes null and void.

Who is the beneficiary in a bank guarantee?

In most cases, the seller is the beneficiary of a bank guarantee.

What is the difference between the expiry date and the claim date in a bank guarantee?

The claim date is the date on which a beneficiary claims the benefits of the bank guarantee while the expiry date is the date by which the claim has to be made.

What is the claim period of a bank guarantee?

The claim period is a time period within which the beneficiary can claim the benefits of the bank guarantee.

Where does the bank guarantee appear on the balance sheet?

A bank guarantee is considered a contingent liability.

What is the limit of a bank guarantee?

If a company regularly requires bank guarantees, the bank often issues them the guarantees with a fixed upper amount known as the bank guarantee limit.

When is a bank guarantee invoked?

A bank guarantee is invoked by the beneficiary when the borrower fails to conclude the trade as per the terms agreed upon by both parties.

Can a bank guarantee be amended?

Yes, a bank guarantee can be amended. Both, the amount, as well as, the duration can be increased or decreased by sending a formal application of the same to the bank.

Can a bank guarantee be revoked?

A bank guarantee is automatically revoked once its tenure is completed or the applicant pays the beneficiary.

Can a bank guarantee be extended?

Yes, a bank guarantee can be extended by sending a formal application of the same to the bank.

What is a bank guarantee to customs?

To avail exemption from import duties, in many cases, the importer has to submit a bank guarantee to customs along with a bond.

Alose Read: