In the dynamic business world, securing large orders is an opportunity for growth, but for many small businesses and startups, the challenge lies in fulfilling these orders due to limited working capital. Have you ever found yourself declining a lucrative deal simply because you couldn’t afford the upfront costs? This is where Purchase Order (PO) Financing comes in.

By providing the necessary funds to cover supplier costs, PO financing ensures businesses can deliver on customer orders without depleting their cash reserves. Whether you’re a manufacturer, wholesaler, or distributor, this financing option empowers businesses to seize growth opportunities while maintaining healthy cash flow.

In this guide, we’ll explore purchase order financing, how it works, its costs, benefits, and drawbacks, and offer tips on choosing the right PO financing company. This guide explains how this funding option can unlock your business’s potential.

What is Purchase Order Financing?

Small businesses and start-ups often face liquidity crunch and cash flow challenges, which can sometimes prevent them from accepting new and large customer orders.

Purchase Order Financing is a specialized funding solution to help small businesses and startups meet their short-term capital needs to fulfil large customer orders.

This financing provides a cash advance of up to 100% to the seller's supplier based on a customer's purchase order. These funds enable the supplier to produce and deliver goods on time, ensuring the order is completed seamlessly.

Once the goods are delivered, the customer pays the finance company for the purchase order. After deducting its fee, the financing firm transfers the remaining balance to the business, ensuring smooth cash flow and hassle-free transactions.

A purchase order is a legally binding contract between the buyer and seller, which works as collateral under this arrangement. The financing company reviews the customer’s creditworthiness and the seller’s relationship with the customer and supplier before extending the required funds. In most cases, funds are offered on a non-recourse basis, i.e., in case of payment default by the customer, the purchase order financing company has to bear the risk.

Purchase Order Financing is applicable for export and import financing, where funds are usually extended for shorter durations of 30-90 days, with an average of 45 days.

How Does Purchase Order Financing Work?

Purchase order financing is a straightforward process designed to bridge the cash flow gap for businesses.

- Customer Order Received: The business receives a large customer order but lacks sufficient funds.

- Application for Financing: The business approaches a purchase order financing company for funding.

- Evaluation: The financing company assesses the order, focusing on the customer's creditworthiness and the supplier's reliability.

- Approval and Funding: The financing company directly pays the supplier to produce and deliver the goods upon approval.

- Order Fulfillment: The supplier manufactures and ships the goods to the customer.

- Payment Collection: The customer pays the financing company directly upon receiving the goods.

- Fee Deduction: The financing company deducts its fees from the payment received.

- Remaining Balance: The remaining balance is transferred to the business, providing them with profits and improving cash flow.

Purchase Order Financing Costs

The cost of purchase order financing varies depending on factors such as the order size, the repayment duration, the customer's creditworthiness, and the supplier’s reliability. Here’s a breakdown of typical costs:

- Interest Rates: Typically range from 1.8% to 6% per month, depending on the financier and risk involved.

- Monthly Fees: Some companies charge additional fees, often increasing after 30 days. For example, a rate might start at 2% per month and increase by 0.5% every 15 days thereafter.

- Annual Percentage Rate (APR): When converted, the cost of purchase order financing can range from 20% to 75% APR, making it more expensive than traditional loans.

- Other Charges: Administrative or processing fees may also apply.

These costs can significantly reduce profit margins, so businesses must carefully evaluate whether this financing option aligns with their financial goals.

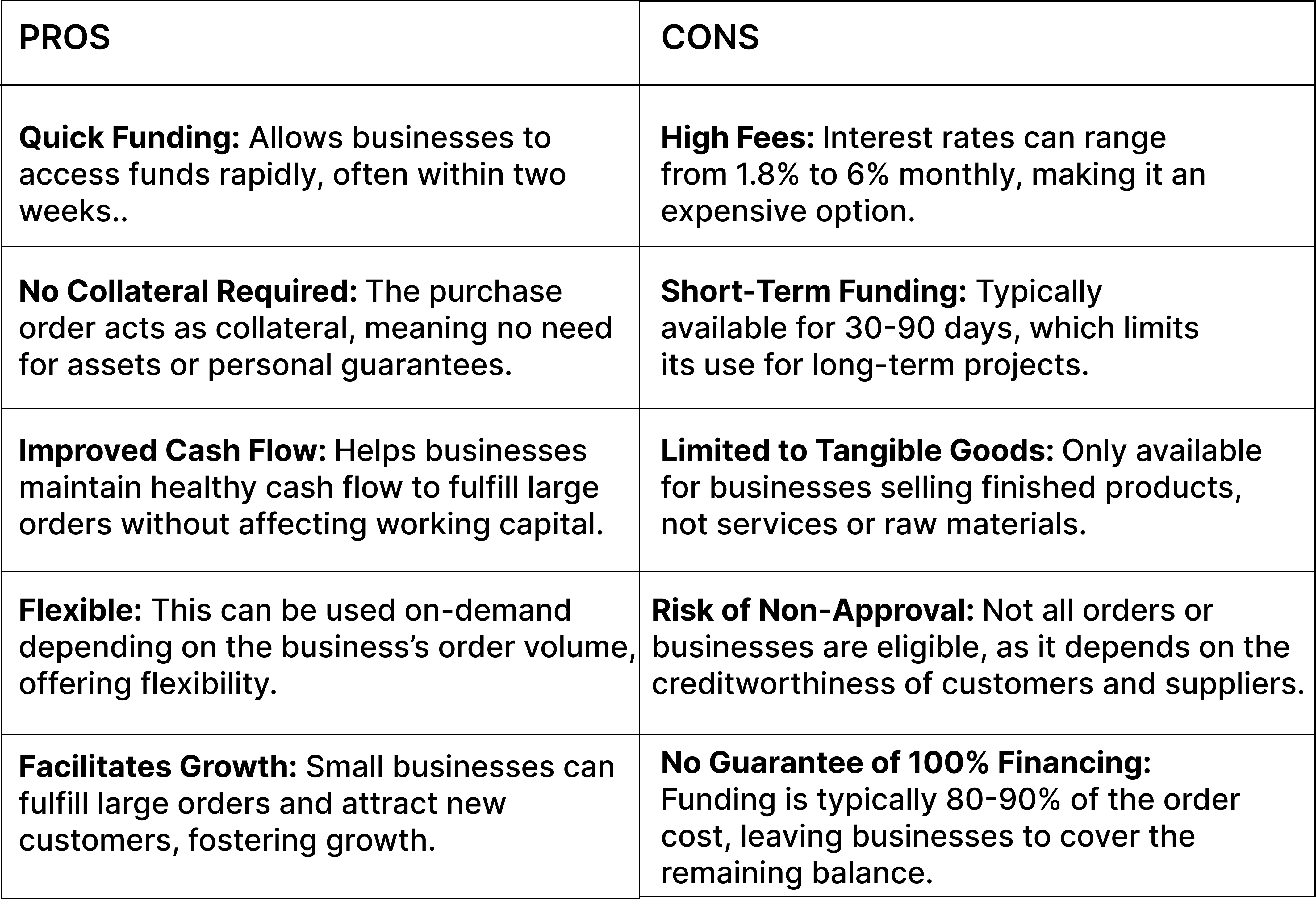

Pros and Cons of Purchase Order Financing

Here’s a table summarizing the pros and cons of purchase order financing:

How to Get Purchase Order Financing

Here’s a step-by-step guide on how to get Purchase Order Financing:

1. Determine Eligibility:

Before applying for purchase order financing, ensure your business meets the essential eligibility criteria. Typically, financing companies require businesses that sell tangible, finished goods and work with reputable customers and suppliers. Your business should also have profit margins of at least 15-20% on the order.

2. Find a Reliable Financing Company:

Look for purchase order financing companies that offer flexible and competitive terms. Some popular providers include Drip Capital, Fundbox, and BlueVine. Evaluate their rates, funding terms, and customer service to choose the best fit for your business needs.

3. Submit a Purchase Order:

To initiate the financing process, submit a purchase order from your customer to the financing company. This document is essential for the financing firm to assess the order and your customer’s creditworthiness.

4. Provide Required Documents:

Along with the purchase order, you will typically need to provide other documentation, such as:

- Supplier invoice

- Invoice to your customer

- Financial statements (balance sheet, cash flow, and profit/loss statements)

- Tax filings (if applicable): This documentation helps the financing company assess the viability of funding your order.

5. Review and Approval:

The purchase order financing company will evaluate the order, including the customer's creditworthiness and the supplier’s ability to fulfill the order. They will decide whether to approve the financing request and, if approved, how much they will fund (usually 80-90% of the order value).

6. Get Funds:

Once approved, the financing company will pay your supplier directly, allowing them to produce and deliver the goods. The funds are typically transferred to the supplier within a short time frame.

7. Order Fulfillment and Payment:

After the goods are delivered, your customer will pay the financing company directly. The financing firm will deduct its fee (usually 1.8%-6% per month) and transfer the remaining balance to your business.

8. Repayment:

The purchase order financing company collects payment directly from your customer, reducing your risk. Once the payment is received, they settle the transaction by paying you the balance after deducting their fees.

By following these steps, you can successfully secure purchase order financing to fulfill large orders and maintain cash flow without the need for additional collateral or personal guarantees.

How to Select a Purchase Order Financing Company

When choosing a purchase order financing company, it's essential to select a reliable partner that aligns with your business needs and can provide the necessary funds to fulfill customer orders efficiently.

1. Assess Your Business Needs

When considering purchase order financing, ensure the company can handle your specific order size, industry, and capital requirements. This is crucial for selecting a provider that aligns with your business goals.

2. Compare Costs

Different purchase order financing companies charge varying rates. Evaluate interest rates, fees, and repayment terms to find a financing solution that fits your business budget and ensures profitability.

3. Seek Flexibility

Look for a financing company that offers flexibility, such as the ability to finance up to 100% of the order value or one that adapts to fluctuations in your order volume or business needs.

4. Research Reputation and Experience

It's important to choose purchase order financing companies with a solid reputation. Read customer reviews, check their track record, and ensure they have experience working with businesses in your industry for better service.

5. Evaluate the Approval Process

The approval process should be efficient and straightforward. Opt for companies that offer a quick turnaround with minimal documentation and a clear understanding of your needs.

6. Customer Support and Communication

Strong customer service is essential. Select a company that provides reliable support, clear communication, and is easily accessible to address any issues promptly.

7. Consider Additional Services

Some purchase order financing companies offer supplementary services, such as supply chain financing or specialized tech solutions. These could further streamline your business operations.

In conclusion, purchase order financing offers businesses a powerful solution for growth and expansion. It provides the essential cash flow needed to fulfill large orders, helping businesses improve their credit, minimize risks, and boost cash flow. If your business is facing challenges in meeting the demands of sizable customer orders, exploring purchase order financing companies could be the ideal option to bridge the gap and support your operational needs.

Frequently Asked Questions

What is the interest rate for purchase order financing?

The interest rate for purchase order financing typically ranges from 1.8% to 6% monthly. The exact rate depends on various factors, including the order size, repayment terms, and the creditworthiness of the buyer and supplier.

What is a reasonable interest rate for financing?

A reasonable interest rate for purchase order financing is around 2% to 3% per month. Lower rates may indicate better terms, but evaluating the total cost of financing, including any additional fees, is essential.

What are the fees associated with purchase order financing?

In addition to the interest rate, purchase order financing companies may charge fees based on the amount financed, typically ranging from 1.8% to 6% monthly. It's important to inquire about any hidden fees or variable rate changes.