Invoice Discounting is a financial device that allows businesses to utilize funds in unpaid invoices. It is beneficial for small and medium enterprises (SMEs) facing cash flow challenges due to delayed payments from clients.

Understanding different invoice discounting will significantly help manage businesses' working capital and growth initiatives. This article describes the definition, process, significant advantages, disadvantages, defining features of invoice discounting, and how Drip Capital can help businesses with this financial solution.

What is Invoice Discounting?

Invoice discounting is the kind of short-term borrowing where an unpaid invoice is sold by a business to a third-party lender at a discount. With this option, immediate cash availability allows the companies to take care of other things, such as financing for development, operating expenses, and effective cash flow management. The idea is to use the existing value in the invoice to obtain money relatively quickly and avoid waiting for clients to settle accounts with the business organization.

Invoice Discounting Meaning

The invoice discounting meaning is straightforward: converting unpaid invoices into immediate cash. Selling invoices at a discount allows businesses to receive immediate cash for part of the invoice's value, while the rest would be paid out on the customer's payment of the invoice amount.

Also Read: What is a Cash Conversion Cycle (CCC)?

This is a significant financial product for firms that give credit terms to customers and would like money between the time that goods or services are provided to the customer and the time that payment has been received.

How Does Invoice Discounting Work?

Businesses need to understand how invoice discounting works as a form of financing: invoice discounting generally involves these steps:

1. Issuing Invoices

Issuing an invoice is when a sale has been transacted by the business organization with a customer concerning goods or services. The invoice will show the full amounts due when they will be paid, and the payment terms. Such invoices form part of accounts receivable for the business and will appear as one of the balance sheet items.

2. Submitting Invoices for Discounting

The business submits the unpaid invoice to an invoice discounting service provider, such as a bank or specialized financial institution. The provider evaluates the invoice and the client's creditworthiness.

3. Receiving the Advance

In the wake of invoice approval, the service provider pre-finances typically between 70%-90% of the invoice value. This pre-finance permits the company to get liquidity immediately to make its payments and invest in growth opportunities.

4. Collecting Payment from the Client

However, the business is still responsible for collecting payments from clients. The money collected goes toward remittances to the invoice discounting provider when the client pays the invoice.

5. Settlement and Fee Deduction

Thus, the advance and subsequent fees are deducted from the amount received, while the remaining sum gets paid to the business. Full payment of the invoice minus costs or expenses for discounting is what the company gets in the settlement process.

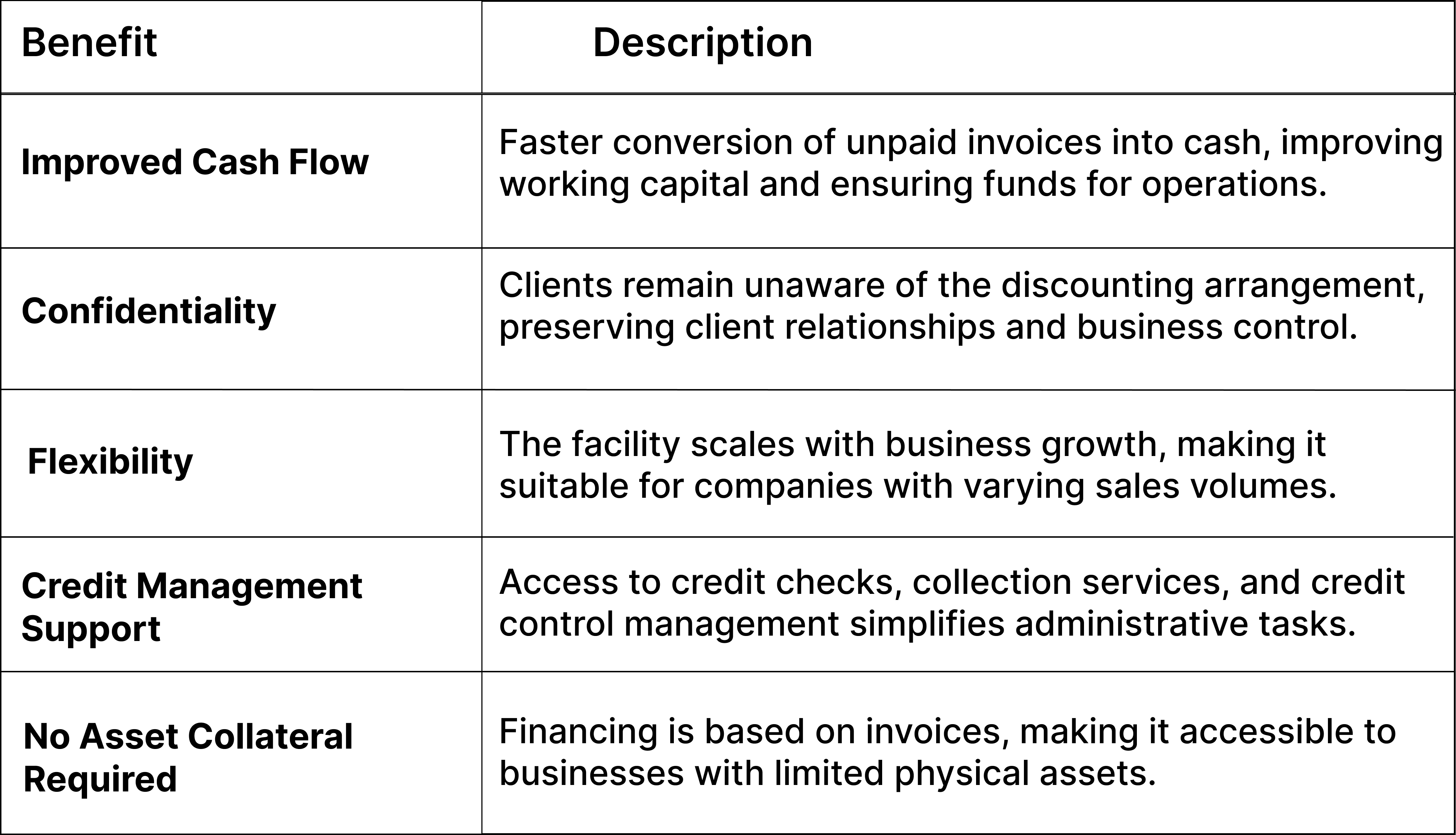

Advantages of Invoice Discounting

Invoice discounting offers a lot of things to businesses, which is why one may consider it a financing method. Here are some significant advantages of invoice discounting:

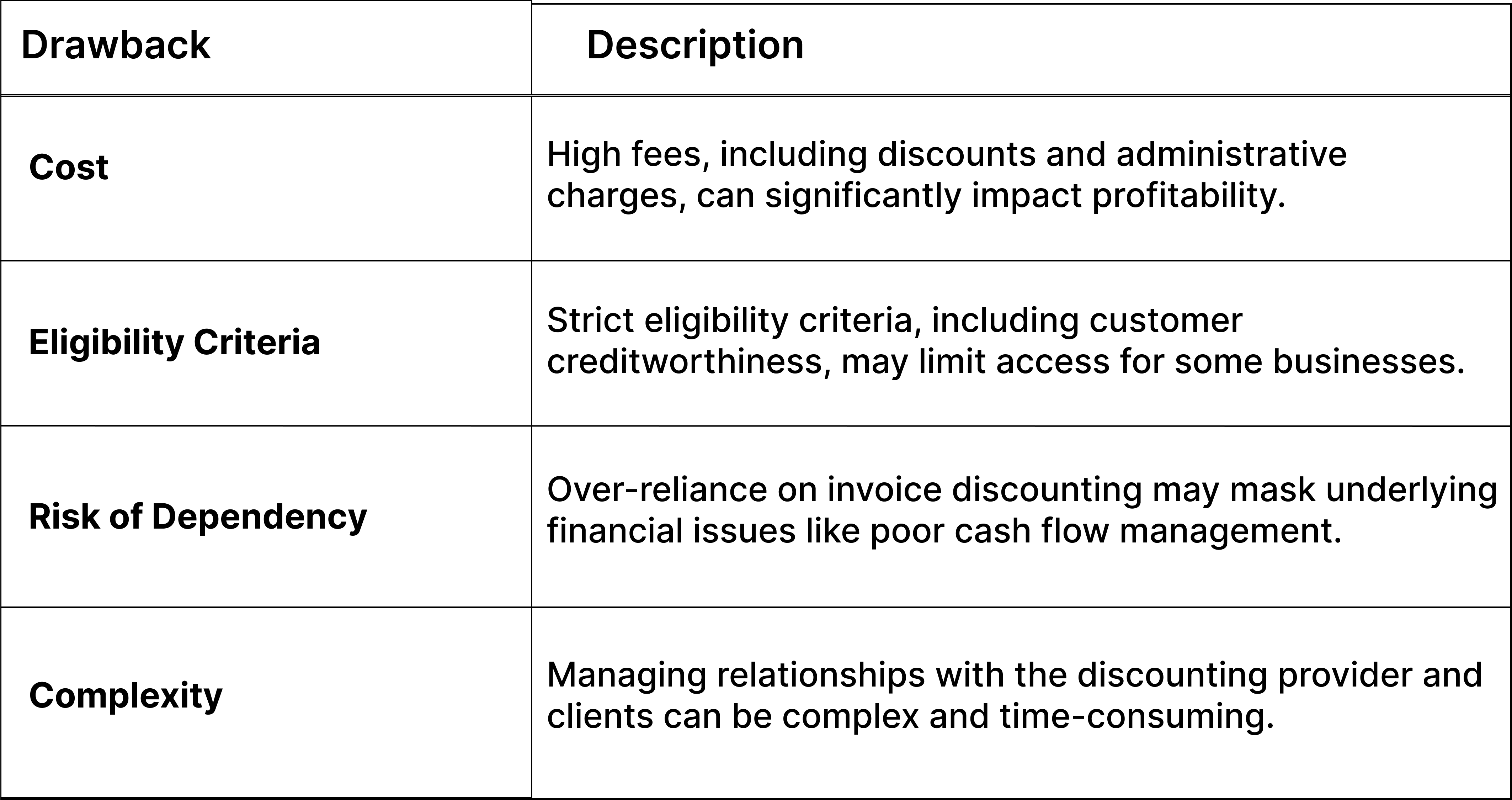

Disadvantages of Invoice Discounting

While invoice discounting offers numerous benefits, it also comes with some drawbacks. Here are some significant disadvantages of invoice discounting:

Key Features of Invoice Discounting

The most extraordinary aspect of invoice discounting has been its ability to provide instant cash access based on unpaid invoices. Several distinctive features characterize this kind of finance:

1. Speed

Invoice discounting allows accessing cash extremely swiftly, generally within 24 or 48 hours of submitting an invoice. Speedy cash availability is vital to companies with immediate pressing cash needs.

2. Scalability

The facility can be increased or reduced according to volume sales within the business and the number of invoices generated. Hence, it caters to the scaling needs of those looking to gain access as they grow.

3. Confidentiality

Now, all customers will remain oblivious regarding the discounting procedure. This also helps businesses in managing their client relationships and maintaining their image.

4. Flexibility

Invoice discounting offers flexible funding amounts and repayment terms. Clients have control over when to submit which invoices for discounting and the timing of their cash flows.

5. Credit Support

Many providers offer complementary credit management services. Credit services are essential to businesses since they can enrich a company's credit control mechanism and reduce bad debt risk.

How Drip Capital Can Help

Drip Capital is a front-runner in invoice discounting and offers an excellent mechanism for unlocking cash stagnated by unpaid invoices-neatly and seamlessly. Here is how Drip Capital can bring value to enterprises in the process of invoice discounting:

1. Quick Access to Funds

Once invoices are submitted, funds can be accessed from Drip Capital between 24 and 48 hours. This turnaround is essential as it fulfils the immediate cash flow exigencies and keeps the business running.

2. Flexible Financing Solutions

Drip Capital lends flexible terms, specializing in the needs of every business, from start-ups to seasonal enterprises, with access to Drip Capital, which has no limit in funds for carrying out these activities.

3. Credit Management Support

Besides funding, Drip Capital also has credit management support services such as credit checks and collections assistance. According to these services, businesses can shrink their accounts receivable responsibilities and improve their credit control processes.

4. No Asset Collateral Required

At Drip Capital, no pledge of physical assets as collateral is required. The invoices act as collateral for the advance, making it available to companies that have landed comparatively less in fixed assets.

Invoice discounting is a financial instrument that helps businesses wheedle out cash from their unpaid invoices. Therefore, this tool is used to manage working capital more efficiently through immediate cash access for operational expenses, investment opportunities, etc.

An informed approach to invoice discounting would include understanding its definition, process, advantages, disadvantages, and key features. Companies should opt for invoice discounting because it is an effective model for maintaining liquidity, improving cash flow, and achieving financial goals with the support of providers like Drip Capital.

Frequently Asked Questions

1. How long does it take to avail of funds through invoice discounting?

Discounting an invoice and waiting for funds generally takes 24-48 hours from the time you submit it. This would entail immediate cash flow, which needs to keep one on an even keel.

2. How can invoice discounting benefit businesses?

It improves cash flow by allowing companies early access to funds to pay operational costs or invest in future growth opportunities. It is flexible, provides anonymity, and expands as necessary, making it an enticing form of finance for companies of all shapes and sizes.

3. What is the meaning of invoice discounting?

Invoice discounting is a means of short-term financing in which cash is immediately raised from unpaid sales invoices. These invoices are sold to a third party at a discount in such cases. They are used to improve working capital management for those companies, bridging the time between the delivery of goods and services and the opportunity of receiving payment.