As tricky as it is, corporate finance allows one to understand and analyze key financial measures to maintain and improve business health. Such a measure includes Days Payable Outstanding (DPO). Acquisition and mastery of the concept and use of Days Payable Outstanding can significantly enhance a company's management of cash flows, operations, and overall financial stability. This guide delves into DPO in detail, how to compute it, how important it is, benefits, and demerits.

What is DPO?

Days Payable Outstanding (DPO) is a measure of the number of days, on average, that the company takes to pay its suppliers and vendors. This measure reflects the efficiency with which it manages its accounts payables and indicates its cash flow management. Higher DPO suggests that the company takes longer to settle its bills, giving direct implications for better management of cash flows. Yet, this could prove challenging for the suppliers. A low DPO indicates that the enterprise has efficiently converted its payables into cash at the respective suppliers but limits the cash available for operations.

Days Payable Outstanding Formula

The calculation of Days Payable Outstanding is relatively straightforward. The formula on how to calculate days payable outstanding is as follows:

DPO = (Accounts Payable/Cost of Goods Sold) x (Number of Days)

In this formula:

- Accounts Payable refers to the amount the company owes its suppliers and vendors.

- Cost of Goods Sold (COGS) represents the direct costs attributable to the production of the goods sold by the company.

- Number of Days typically refers to one year (365 days) or the specific period being analyzed.

By applying this formula, businesses can determine how many days, on average, they take to pay their suppliers and manage their accounts payable.

Importance of Days Payable Outstanding (DPO)

Days Payable Outstanding would be understood and tracked because it serves a purpose that is explained below:

- Cash Flow Management: One of the most effective uses of DPO is cash flow management. This means delaying payments to suppliers so that the organization can use the retained cash for other operational requirements, investments, or debt reduction.

- Supplier Relationships: DPO might benefit a firm with cash flow, but it should be matched with healthy supplier relationships.

- Financial Health: The actual DPO ratio is essential to the company's financial health and operational efficiency. It shows how well a company uses working capital and its ability to meet short-term obligations without harming the long-term economic health of the enterprise.

- Operational Efficiency: Monitoring DPO can help identify inefficiencies in the accounts payable process and highlight areas for improvement. It can also serve as a benchmark for comparing a company's performance against industry standards.

How to Improve Days Payable Outstanding

Days payable outstanding (DPO) are essential for a company as they affect cash flow and financial health. Below are the effective strategies for improving DPO:

- Negotiate Better Terms with Suppliers: You can expand the length of time that a company has to make payments while continuing to develop ramped relationships with suppliers. Building relationships with suppliers in an open, candid manner will generally produce better terms and relieve cash flow.

- Automate Accounts Payable Processes: With the help of accounting packages software and digital invoicing systems, paying becomes easier, and cash flow control is enhanced.

- Regular Review and Analysis: DPO is easy to monitor and review for optimal cash flow management.

- Effective Cash Flow Management: Managing all aspects of the forecasted cash needs, optimal inventory levels, and timely collection of receivables is critical to improving DPO.

- Leverage Early Payment Discounts: Some suppliers offer discounts for early payment. It is possible to improve DPO by extending the time to payment provided to suppliers, but early payment discounts also benefit the company.

For example, negotiating pays for a significant portion of the suppliers with whom the company typically negotiates payment terms of 30 days to 60 days within which to make payment. The DPO here increases from 30 to 60 days with such policies. This gives the company a doubled period for holding cash. These extra funds will serve for business growth or the settlement of long-term debts.

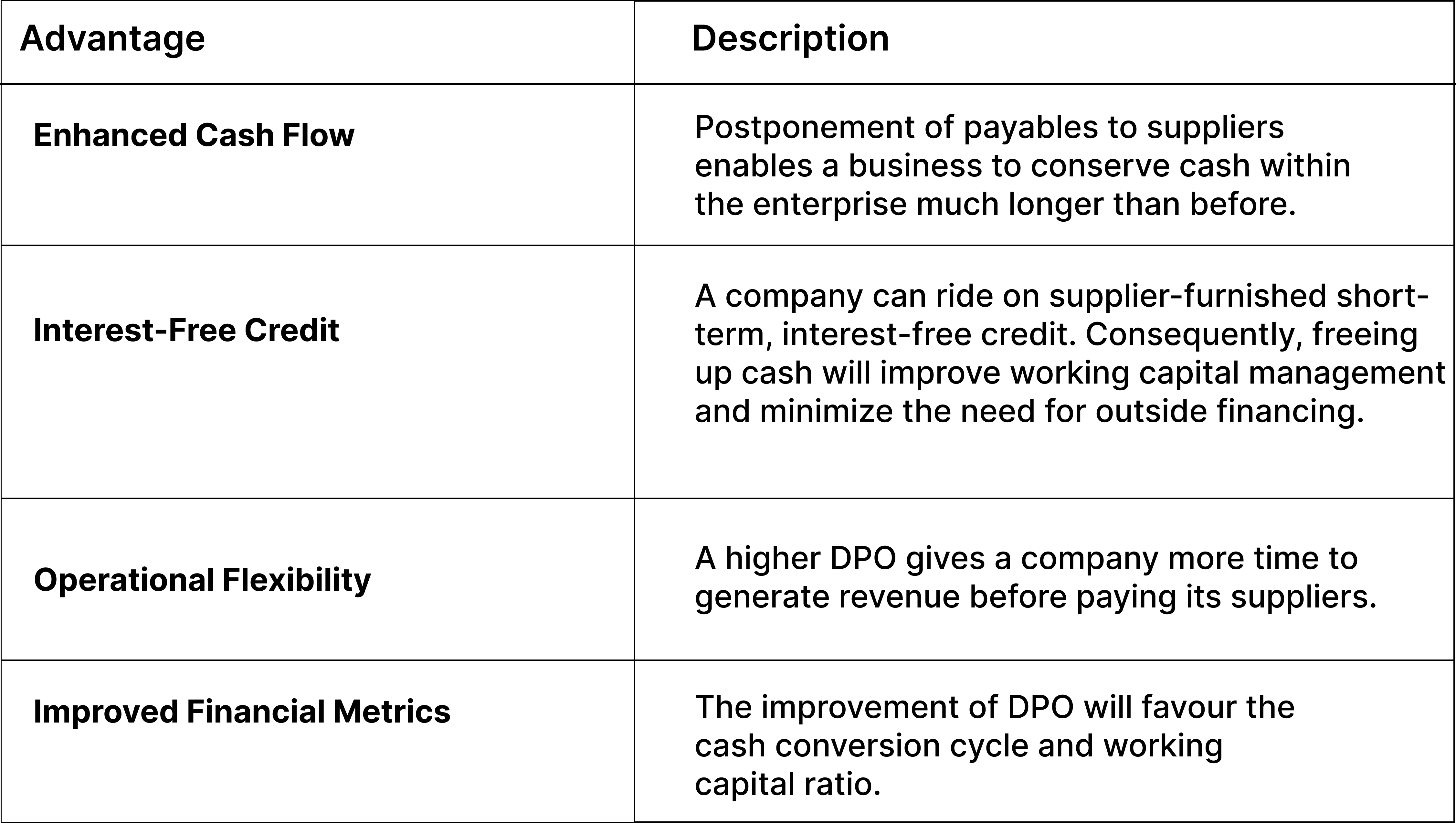

Advantages of DPO

Understanding and optimizing DPO offers several advantages for businesses:

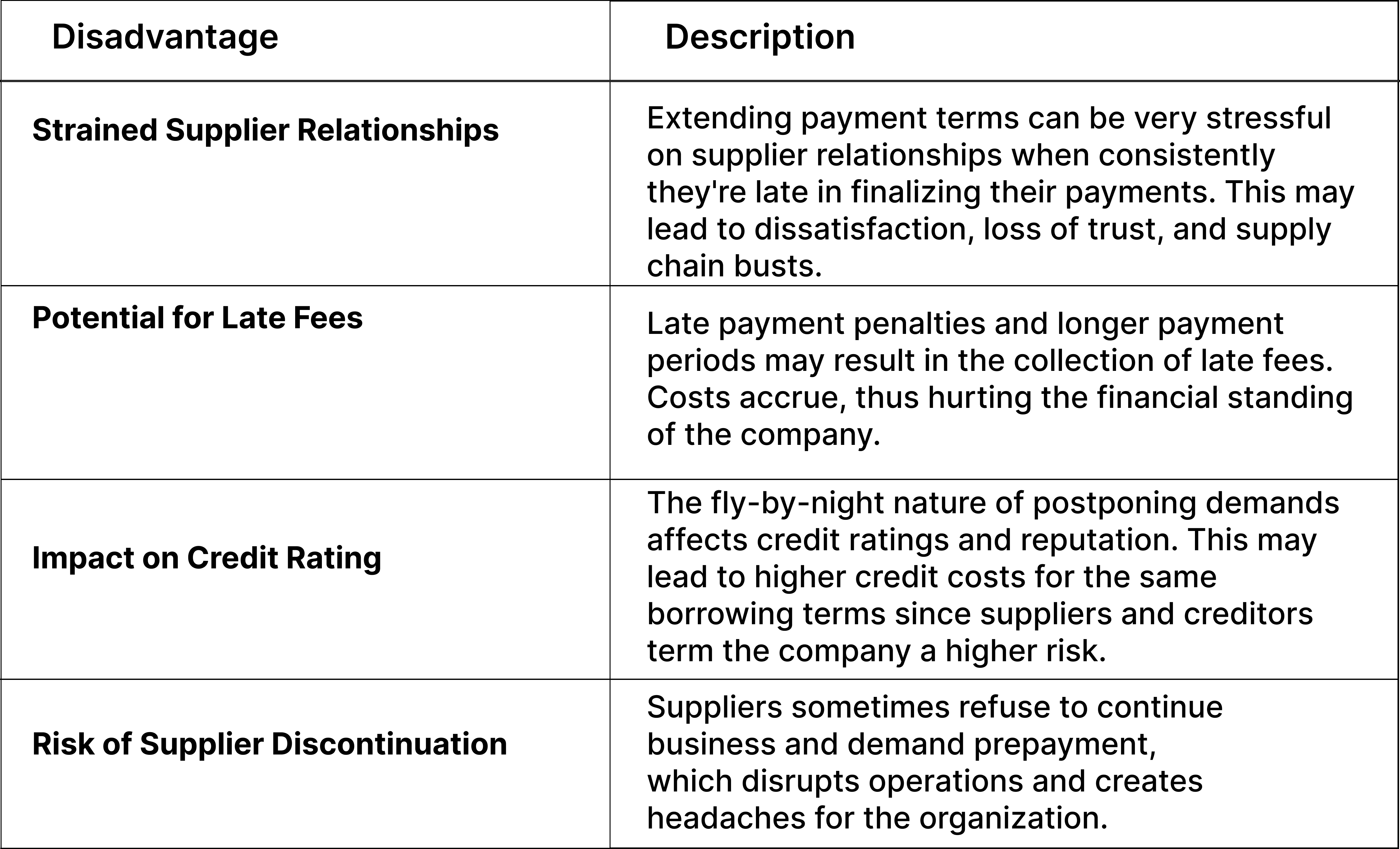

Disadvantages of DPO

While there are several advantages to optimizing DPO, it is essential to consider the potential disadvantages:

Let us understand it with the help of an example: With a DPO recorded at 120 days, far exceeding the industry average, a company finds that the suppliers are reluctant to extend the payment terms that benefit the company. As a result, the company has to incur additional costs and source materials flexibly. This illustrates the difficulty of balancing a very high DPO against the danger it may pose to supplier relationships and the company.

The payment process to the creditors varies from company to company and is measured in terms of Days Payable Outstanding (DPO). This proves to be a critical cash flow management consideration and an essential component of sound financial health in any company. With the knowledge of the formula and application of DPO, firms can optimize invoice payable practices and thus develop a good relationship with creditors.

Frequently Asked Questions

1. What is the difference between DPO and DSO?

Days Payable Outstanding (DPO) measures the average days a company considers when paying suppliers. In contrast, Days Sales Outstanding (DSO) measures the average number of days spent collecting a customer's payment. Both dimensions are critical in evaluating a company's cash flow management and general financial health.

2. How do you calculate Days Payable Outstanding?

The Days Payable Outstanding formula is calculated as shown:

DPO = (Accounts Payable / Cost of Goods Sold) x (Number of Days)

The DPO (Days Payable Outstanding) formula would show the average number of days the company holds before it pays its suppliers for goods.

3. Should DPO be high or low?

A company's high DPO indicates it is doing a good job managing cash flows. The company then holds cash for longer before money is committed to paying suppliers. The constant delay in payment will ultimately affect supplier relationships. Likewise, low DPO entails faster payments to suppliers, which builds a healthy relationship with suppliers at the expense of cash.

4. What affects DPO?

Several factors can affect DPO, including:

- Payment Terms: The negotiated payment terms with suppliers.

- Accounts Payable Process Efficiency: The efficiency of the accounts payable process and automation tools.

- Industry Standards: The typical payment practices and standards within the industry.

- Cash Flow Management: The company's overall cash flow management practices and strategies.