Corporate financial management acts as the pillar on which a successful organization stands. Include accounts payable and accounts receivable; all areas of finance are essential for any company's smooth and financially sound operation. These two critical components perform separate but joint functions that draw cash flow into the company. The knowledge of accounts payable plus accounts receivable processes is a must for maintaining the financial state's operational status regarding definitions, processes, importance, and differences between accounts payable and accounts receivable.

What is Account Payable?

Accounts payable (AP) are what a company owes to suppliers or vendors for goods and services received on credit. In this sense, accounts payable relates to the short-term liabilities of a company to creditors. This is one of the essential elements of financial management that every business has to consider. It would have good supplier relationships as all payment obligations are accomplished on time.

Key Characteristics of Accounts Payable

1. Liability: Accounts payable are recorded as liabilities on the company’s balance sheet because they represent the money the company is obligated to pay in the future.

2. Short-Term Debt: Accounts payable are typical short-term liabilities requiring the payment obligation to be cleared within some time frames, usually ranging from 30 to 90 days for liquidation.

3. Credit Relationship: Accounts payable represent a business relationship, and the terms of credit are already known to the company under which goods or services are procured from suppliers. It makes payments when the goods and services have already been received.

Account Payable Process

The accounts payable process involves a series of steps that ensure the timely payment and correct recording of invoices. The following are the steps:

1. Receiving Invoices

This means when any invoice is received from the supplier, it just gets booked into the company's company's accounts payable system. The invoice amount, terms, dues, and the description of the goods and services received by the company are mentioned under it.

2. Verification

The company checks all the information to ensure it matches the purchase order, delivery receipt, and other documents before verifying the invoice for payment. Detailed verification of the receipt provides the available goods or services as stated.

3. Approval

After proceeding to payment, the invoice must get approval from the company's relevant authority. This ensures the company grounds itself legitimate for payments, not reimbursing unauthorized or erroneous charges.

4. Payment

So, after the invoice is approved, the company pays the supplier before the due date so that any penalty for late payment does not accrue. The payment type can be by electronic funds transfer (EFT), checks, or credit cards.

5. Recording

The payment is also recorded in the company's financial system, and the liability is written off from the accounts payables ledger, thus ensuring that the company's financial records regarding current liabilities are accurate.

What is Account Receivable?

An account receivable is a monetary amount that is to be paid by the customer to the company for goods or services sold on credit. Current assets reflect the value owed by customers to the company. It is also essential because managing accounts receivables is critical for sufficient cash flow within an organization and the organization's financial well-being as a whole.

Key Characteristics of Accounts Receivable

1. Asset: Accounts receivable is recorded as an asset on the company’s balance sheet because it represents the money the company expects to receive.

2. Current Asset: Accounts receivable is considered a current asset because it is expected to be converted into cash within a short period, typically within one year.

3. Credit Sales: If there are accounts receivable, credit is given by a company to its customers such that clients are permitted to make payment after purchasing goods or services from the company.

Account Receivable Process

There are procedures associated with accounts receivable, including several activities for documenting customer payees and retrieving payments promptly. Below is a summary of the processes:

1. Delivering Goods or Services

At its most basic, the accounts receivable process begins with the sale of goods or the provision of services to a customer by an entity. The specific terms regarding the sale, payment obligations, and due dates would then be determined at the point of purchase.

2. Invoicing

After the goods or services have been delivered, the company issues an invoice to the customer. The details included in the invoice include payment terms, due date, total amount, and fees for early payment, where applicable.

3. Recording

The amount shown on that invoice is then entered as an account receivable in the company's ledger, reflecting the amount of money it expects to realize from the customer.

4. Collection

The company then followed up with the customer to have him remit the invoice payment promptly. This could be through follow-up reminders and phone call messages to the customer to check for issues concerning payments to suppliers.

5. Recording Payment

This means that once the customer settles the invoice, the company records it and accordingly reduces its accounts receivable balance. Timely collection of receivables is a must for cash flow.

Importance of Accounts Payable and Receivable

It is crucial to note that the effective management of accounts payable and receivable forms the basis for maintaining a healthy financial status and for the general efficient functioning of the business. Some of the essential things accounting payable and receivable can do include:

Accounts Payable

1. Maintaining Supplier Relationships: The bills are paid promptly so that a good working relationship can be continued with suppliers for a steady supply of goods and services.

2. Cash Flow Management: The management of accounts payable contributes towards cash flow management by ensuring that the company meets short-term obligations without depleting its cash reserves.

3. Avoiding Penalties: Timely payment at the due date can help avoid penalties for late payment and their subsequent effects on the company's financial operations.

Accounts Receivable

1. Ensuring Cash Flow: Proper management of accounts receivable would allow the efficient and smooth supervision of payment flows in time as the cash will flow.

2. Reducing Bad Debts: Efficient credit administration minimizes losses due to bad debts; therefore, the cash is assured to be remitted by the organization.

3. Financial Stability: Credit collection on schedule ensures that the organization will remain financially stable and contribute significantly to growth and expansion in the future.

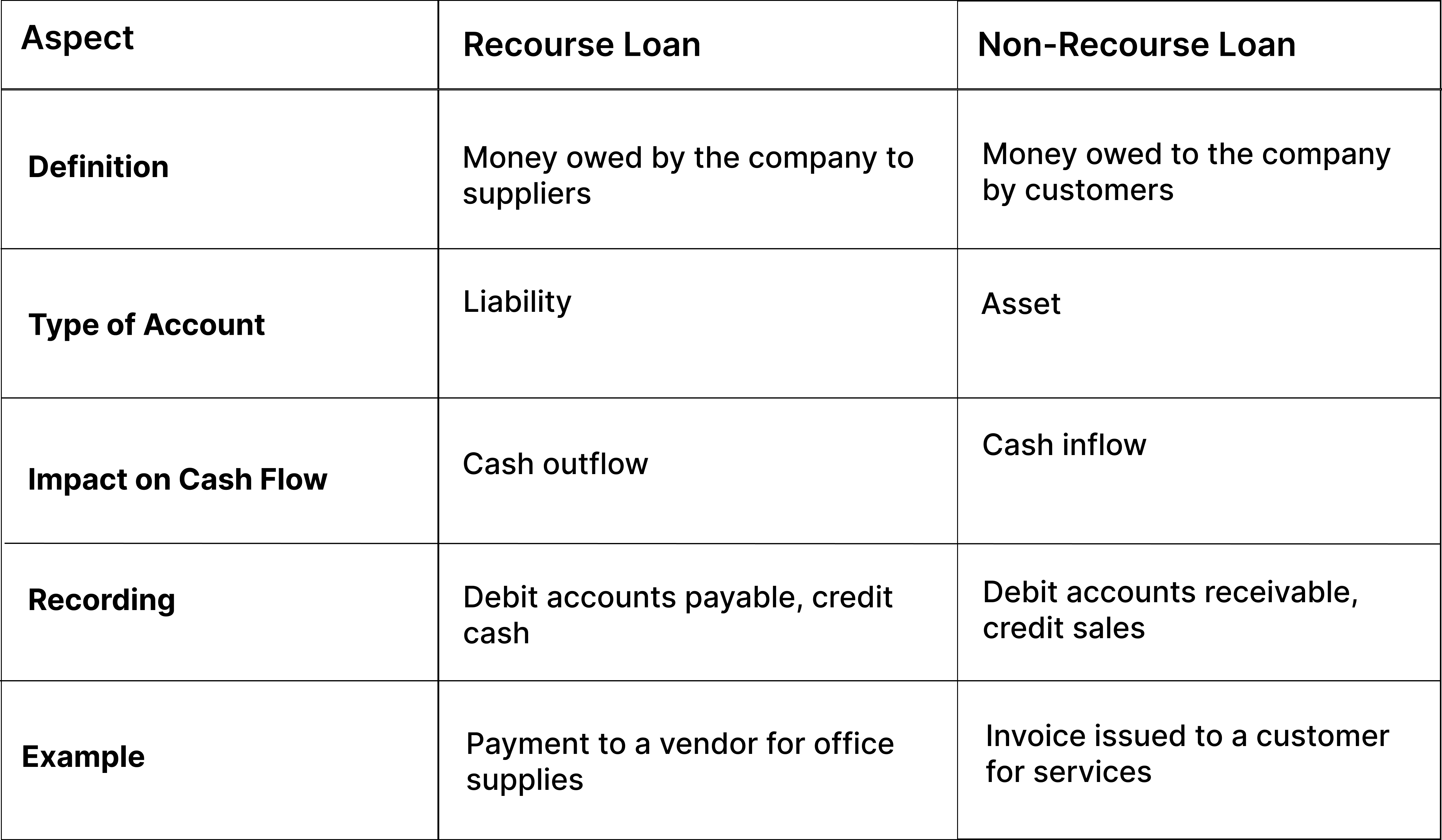

Accounts Payable vs. Accounts Receivable: Key Differences

Understanding the difference between accounts payable and accounts receivable is essential for effective financial management. Here are the key differences between the two:

Additional Differences

1. Financial Statement Impact: The accounts payable account appears in the balance sheet under liabilities and assets for accounts receivable. This gives an idea of these accounts' respective roles in the company's financial structure.

2. Credit Terms: Accounts payable are the credit terms agreed upon with the suppliers, while accounts receivable are the credit terms offered to customers.

3. Management Focus: To develop accounts payable, they will be managing on-time payments with suppliers to maintain good relationships, and on-time collected payments from customers to maintain cash flow management will be focused on accounts receivable.

How Can Drip Capital Help?

Drip Capital helps stakeholders and businesses with accounts payable and accounts receivable in various ways:

1. Drip Capital Controls the Company's AP responsibility:

It pays the supplier’s invoices in advance. Contrary to the conventional practices where the business acquirer waits for 30 to 60 days to make payment, they get the stock immediately and pay to Drip later.

This means that the business provides a smooth cash flow to the entrepreneurs without using their own money to undertake the needs of the business. This affects AR indirectly because it determines when accounts will be invoiced and when payments on existing accounts can be made.

2. Improved Cash Flow:

Proper Accounts Payable management also indirectly promotes AR management by Drip Capital. When a company improves its cash flows, it can channel more resources towards sales and marketing, hence a possibility of improved sales and, subsequently, improved AR.

3. Reduced Risk of Supply Chain Disruptions:

These payments relate to suppliers, and these cover such aspects as ensuring that the supplier is paid on time to guarantee supplies of goods and services required in fulfilling customer orders to get more AR.

Understanding accounts payable vs. receivable is crucial for successful finance management. Both accounting types are needed to balance a business's cash flow and financial viability. However, if an enterprise successfully works on it, every such event will mainly support it in unmanaged operations between supplier and customer growth and expansion.

Frequently Asked Questions

1. What are the similarities between accounts payable and accounts receivable?

Management's accounts payable vs. accounts receivable parts are critical in regulating cash levels and flow within a business. They must ensure the appropriate payables for accurate financial records and settle on time. Furthermore, these documents also play a crucial role in the cash and economic situation of the enterprise.

2. How do you record accounts receivables?

To record accounts receivables, debit the accounts receivable account and credit the sales revenue account. When the customer pays, debit the cash account and credit the accounts receivable account. This ensures accurate tracking of money owed to the company and timely collection of payments.

3. Is invoicing accounts payable or receivable?

Accounts Receivable: This is the sales invoicing for sales made to customers on credit. The invoiced amount will be recorded in accounts receivable, which refers to the money owed by the company's customers.