Understanding the various loan types in finance is vital when borrowing and lending. Recourse loans and non-recourse loans are the two types available. Each of them has its own proper set of advantages and disadvantages. Knowing the differences lets you know which loan option applies more to your situation.

This article focuses on what a recourse loan is, its pros and cons, what a non-recourse loan means, and the advantages it holds. It indicates the three main differences between recourse and non-recourse loans.

What Is a Recourse Loan?

A recourse loan is a type of loan agreement in which the borrower is personally liable for the debt. In the event of default, the lender can go after the borrower's other assets in addition to the collateral used to secure the loan. Thus, if the sale of the collateral fails to meet the outstanding loan amount, the lender is free to pursue other assets belonging to the borrower, such as bank accounts, investments, and even wages, to recover the remaining debt.

Also Read: Difference between debt financing and equity financing

Recourse loans are those in consumer finance, such as mortgage, auto, and business loans. Recourse loans are very high on security levels for lenders since they can recover the loan amount in case of default using more than one way. However, some mortgage loans, particularly those for investment properties, can be non-recourse.

Advantages of Recourse Loans

Recourse loans provide lenders with greater security while offering borrowers the potential for more favorable terms, making them a widely used financing option in various sectors.

1. Lower Interest Rates: Because recourse loans provide lenders with more security, they often come with lower interest rates than non-recourse loans. This can result in significant savings for borrowers over the life of the loan.

2. Easier Approval: Lenders are generally more willing to approve recourse loans because of the added security. Borrowers with less-than-perfect credit may find qualifying for a recourse loan easier.

3. Higher Loan Amounts: With the additional security provided by recourse loans, lenders may be more willing to offer higher loan amounts. This can be beneficial for borrowers who need substantial financing.

4. Flexibility: Recourse loans can be used for many purposes: mortgages, auto, and business loans. It is this flexibility that makes recourse loans very popular with borrowers.

Example of a Recourse Loan An example of a recourse loan is a standard mortgage. If the homeowner defaults on the mortgage, he will foreclose the owner from the property (the collateral). The lender can pursue the borrower's other assets to recover the remaining debt if the subsequent sale of the property does not cover the outstanding loan amount.

Disadvantages of Recourse Loans

Recourse loans pose a significant financial risk to borrowers, as lenders can claim personal assets if the collateral doesn't cover the debt.

1. Personal Liability: This means borrowers are liable for their debts. Even though they have collateral, they risk losing their property and other assets if they default on the loan.

2. Credit Impact: Defaulting on a recourse loan has profound implications on the borrower's credit score. Aside from incurring a judgment, the lender might even initiate possible legal actions against the borrower that may further harm their credit history.

3. Higher Risk for Borrowers: The high-security value for lenders puts the borrowers at very high risk. Think carefully before deciding to be able to repay the loan, as there may be dire consequences upon default.

4. Potential Legal Issues: In case any default occurs, the lender may proceed to file a lawsuit against the borrower to recover the remaining indebted portion. Hence, this incurs many legal fees and psychologically disturbs the borrower.

What Is a Non-Recourse Loan?

To understand the non-recourse loan meaning, one must understand its key associated characteristics. The lender is limited to recovering the amount from the collateral security only because he can take possession and dispose of the pledged collateral in case of a default. Still, he cannot pursue the rest of the borrower's properties.

What does non-recourse mean for borrowers? It means that in addition to having a commercial impact, such as allowing for project financing without recourse, non-recourse loans shield the borrower in that all liability rests solely with the collateral and will not affect the borrower's assets.

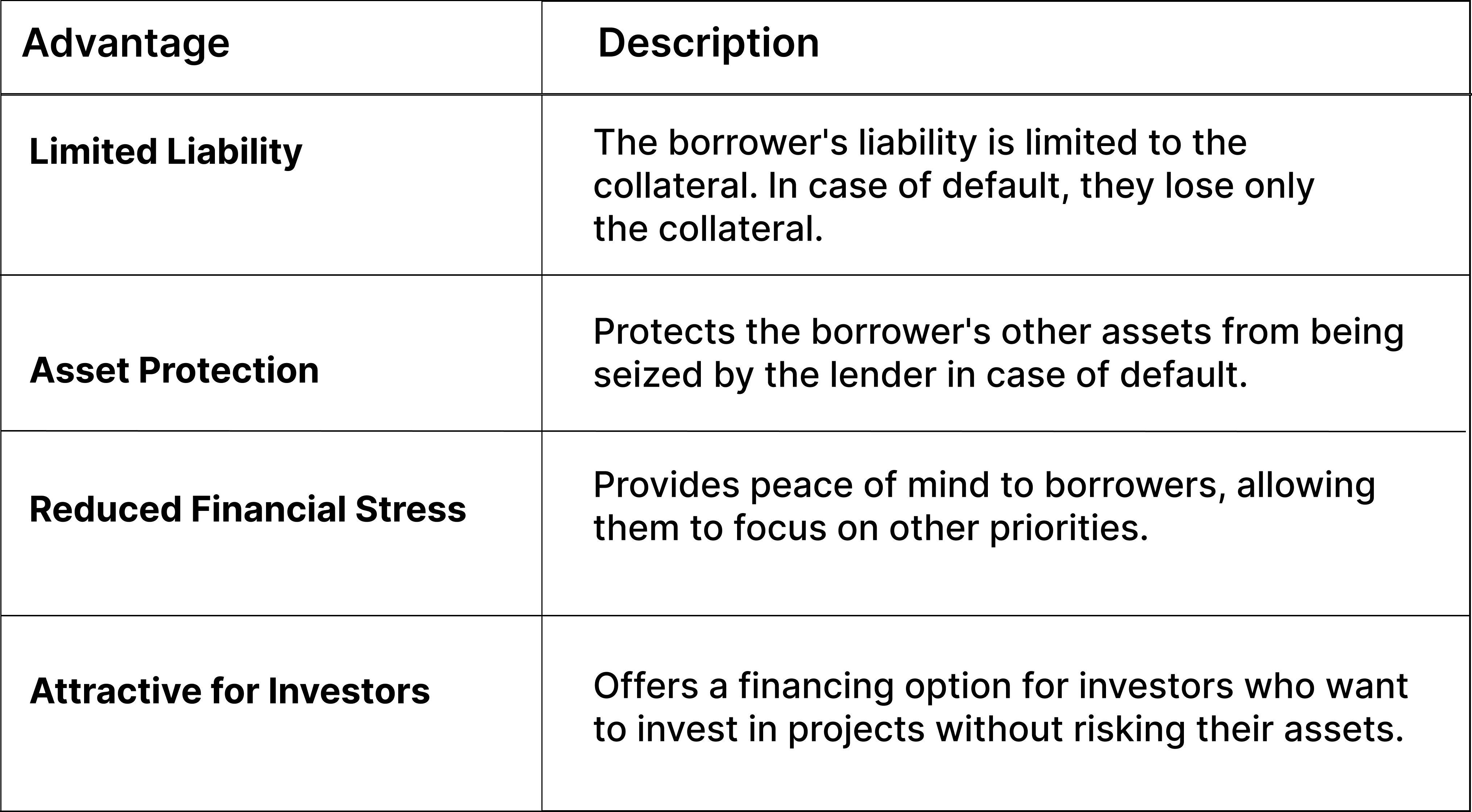

Advantages of Non-Recourse Loans

Here’s a tabular representation of the advantages of Non-Recourse Loans.

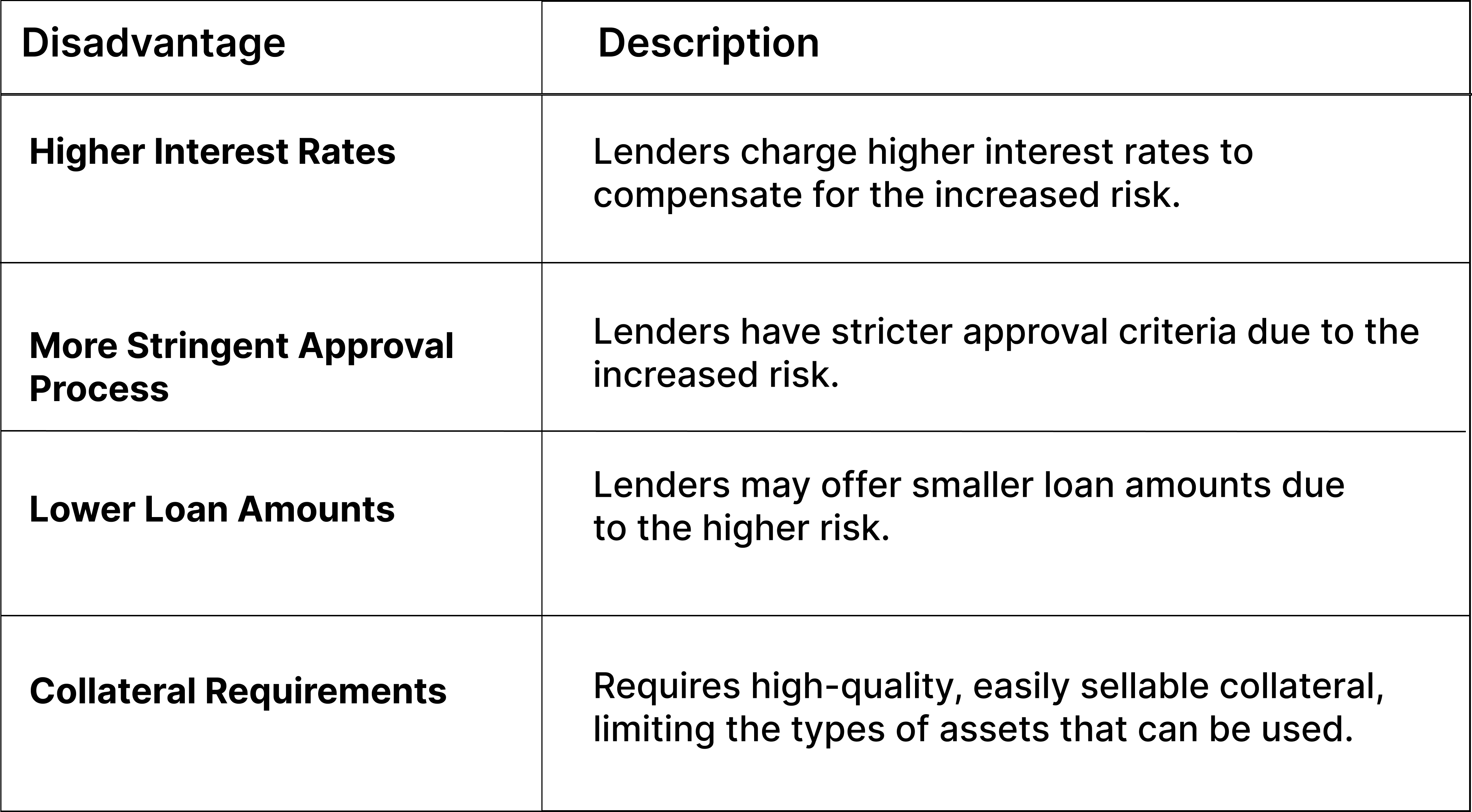

Disadvantages of Non-Recourse Loans

Here’s a tabular representation of the disadvantages of Non-Recourse Loans.

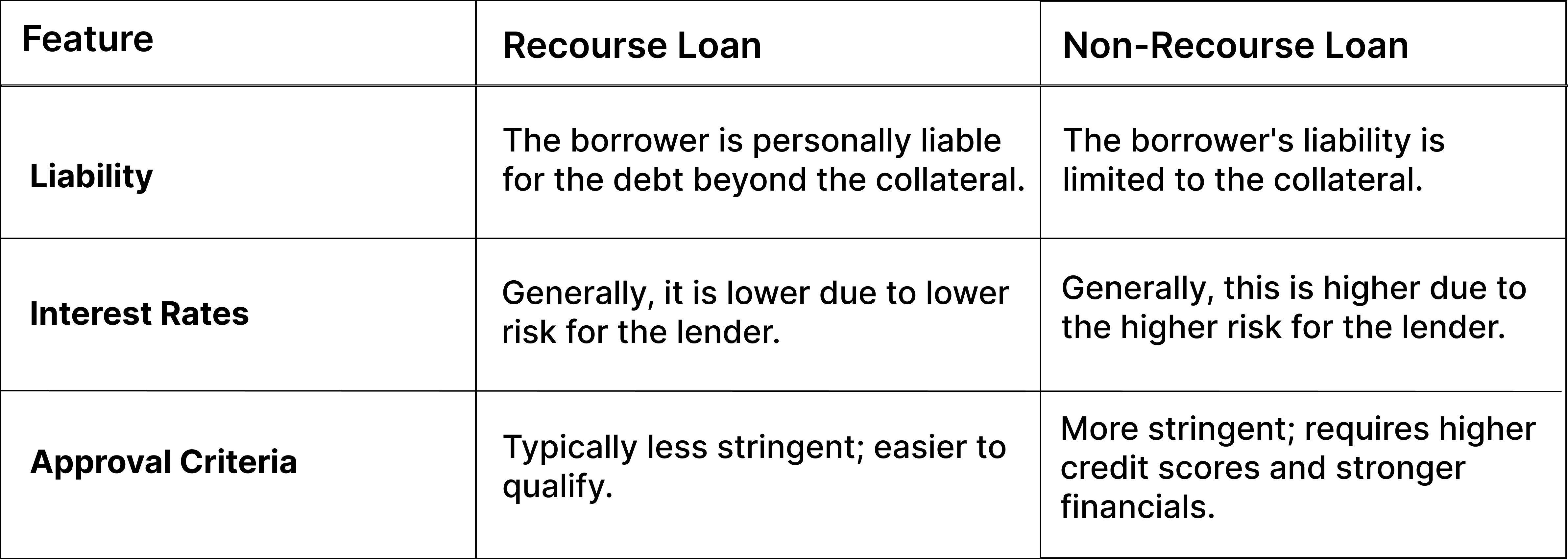

Non-Recourse vs Recourse Loans : 3 Key Differences

The following table summarizes the key difference between non-recourse and recourse loans:

In-Depth Comparison

- Risk to Borrower: In a recourse loan, the borrower bears more risk as personal assets are on the line. In a non-recourse loan, the borrower bears less risk since only the collateral is at risk.

- Lender Security: Lenders have more security in recourse loans since they can pursue additional assets. In non-recourse loans, lenders have limited security confined to the collateral.

- Loan Terms: Recourse loans often offer more favorable terms, such as lower interest rates and loan amounts. Non-recourse loans may have less favorable terms due to the higher risk for lenders.

One must choose a recourse or non-recourse loan based on personal situations, risk appetite, borrowing needs, etc. Recourse loans offer lower interest rates and easier approval but come with personal liability risks. Non-recourse loans would protect the borrower's assets while simultaneously making him liable to some extent. Still, non-recourse loans are loans that carry a high rate of interest and harsh approval conditions. The most crucial difference between them should help any borrower choose the ideal loan alternative most suitable for his financial situation.

Frequently Asked Questions

1. Provide an example of a recourse loan.

An example of a recourse loan is a standard mortgage. If a homeowner defaults on the mortgage, the lender can foreclose on the property (the collateral). If the property sale does not cover the outstanding loan amount, the lender can pursue the borrower's other assets to recover the remaining debt.

2. Provide an example of a non-recourse loan.

An example of a non-recourse loan is a commercial real estate loan. If the borrower defaults, the lender can only seize the property used as collateral and cannot pursue the borrower's other assets.

3. Do banks make non-recourse loans?

Yes, banks offer non-recourse loans and all other financial institutions, primarily commercial real estate financing or project financing. Most importantly, recourse loans are much stricter in approval requirements and interest rates.

4. How do I find out whether I have a recourse or non-recourse loan?

Check the loan agreement or talk to your lender to determine whether you have a recourse or non-recourse loan. Generally, the loan agreement specifies the type of loan and the borrower's liability in case of a default.

5. Which loan option is best for you?

Your financial condition, attitude recourse, and borrowing requirements determine which loan option is best for you. Generally, recourse loans come with lower interest rates and lenient approval standards and are better for qualified individuals. If you intend to protect assets and limit liability, then a non-recourse loan would be best suited for you.