During international trade operations, businesses must bear various expenses, including shipping services combined with insurance, and operate within the constraints of customs duties in addition to taxes and tariffs. Organizations that engage in worldwide commerce need to understand the fundamental concepts of international expenses for both legal compliance and spending reduction purposes. The following article will explain customs compliance principles by examining duties, tariffs, and taxes alongside their computation methods and showing their distinct attributes.

What Are Duties?

War's foreign trade duties represent mandatory government charges which cover imports and exports. The government relies on such duties to generate funds while these levies help control international commerce. Currently, nations use duties as a measure to guard their domestic businesses versus international industry elements by adding excessive costs to imported merchandise.

District regulations and international trade treaties, together with overseas origin watermark and product identity, set the schedule for import fees. Higher import duties apply to luxury items and non-essential goods, but essential commodities qualify for reduced or waived duties under free trade agreement provisions.

How Is Duty Calculated?

Duty is calculated based on several factors, including:

- Customs Value

Customs value represents the total sum of the price of goods together with insurance costs and shipping expenses (known as CIF value).

- Harmonized System (HS) Code

A HSN code system purpose-built to classify worldwide commercial goods. The duty rate for each Harmonized System code exists separately.

- Duty Rate

A percentage value is used to calculate duty on customs values. A product's duty rate depends on both its class type and the country from which it originates.

Example Calculation: If the CIF value of goods is $10,000 and the duty rate is 5%, the duty would be:

Duty = CIF Value x Duty Rate Duty = $10,000 x 0.05 = $500

What Are Tariffs?

A country levies tariffs that represent governmental taxation for items traded across international borders. These share traits with duties yet function primarily as instruments for economic decisions made at the government level. Tariffs can:

- Help national industries achieve their goals through elevated costs of imported products.

- Generate government revenue.

- Influence trade relationships between countries.

What are the Different Types of Tariffs?

- Ad Valorem Tariff

A percentage of the value of the goods. With a 10% tariff applied to $1,000 worth of goods, the taxable amount becomes $100.

- Specific Tariff

The system of taxation imposes one static fee upon each unit sold, which ignores product value. For example, $15 for each pair of shoes imported.

- Compound Tariff

A combination of ad valorem and specific tariffs. For example, a 5% tariff plus $3 per unit.

- Protective Tariff

This trade barrier functions to protect home industries by causing imported items to become more expensive.

- Revenue Tariff

Revenue generation stands as the primary reason for most international taxation programs.

What are Taxes?

Governments enforce mandatory financial obligations on individuals, organizations, and products. In international trade, taxes on goods include:

- Value-Added Tax (VAT)

A taxation method that applies to the creation of new value throughout each production sequence before distribution.

- Goods and Services Tax (GST)

VAT remains similar to its structure, but nations implement it differently according to their specific needs.

- Excise Tax

Tax authorities apply excise taxes, particularly to alcohol, tobacco and fuel products, to discourage public consumption of these goods.

Duty vs Tariff vs Taxes: Key Differences

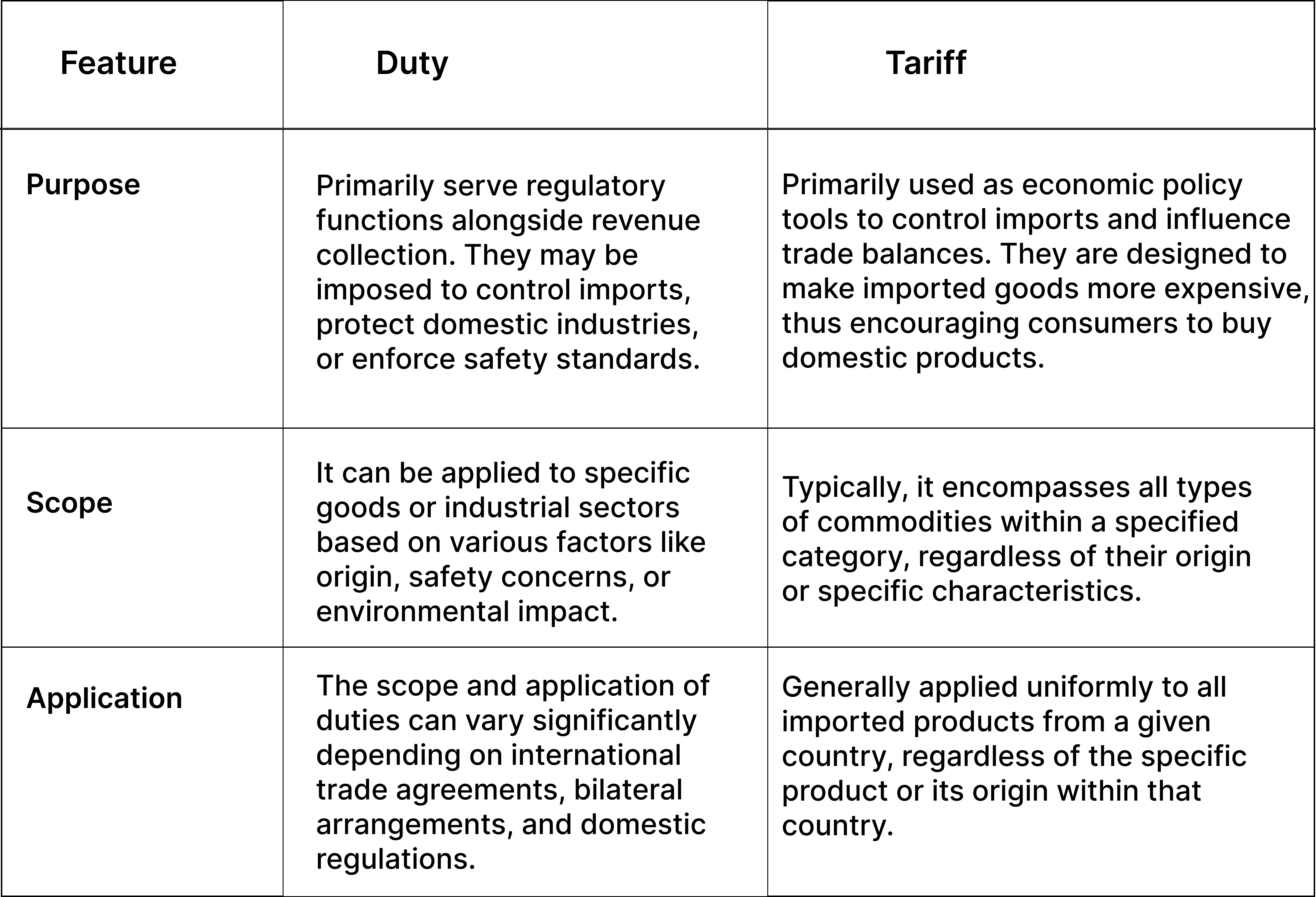

Duty vs. Tariff: Key Differences

To understand duty vs tariff vs taxes, it is important to understand that; while duties and tariffs are often used interchangeably, there are subtle differences:

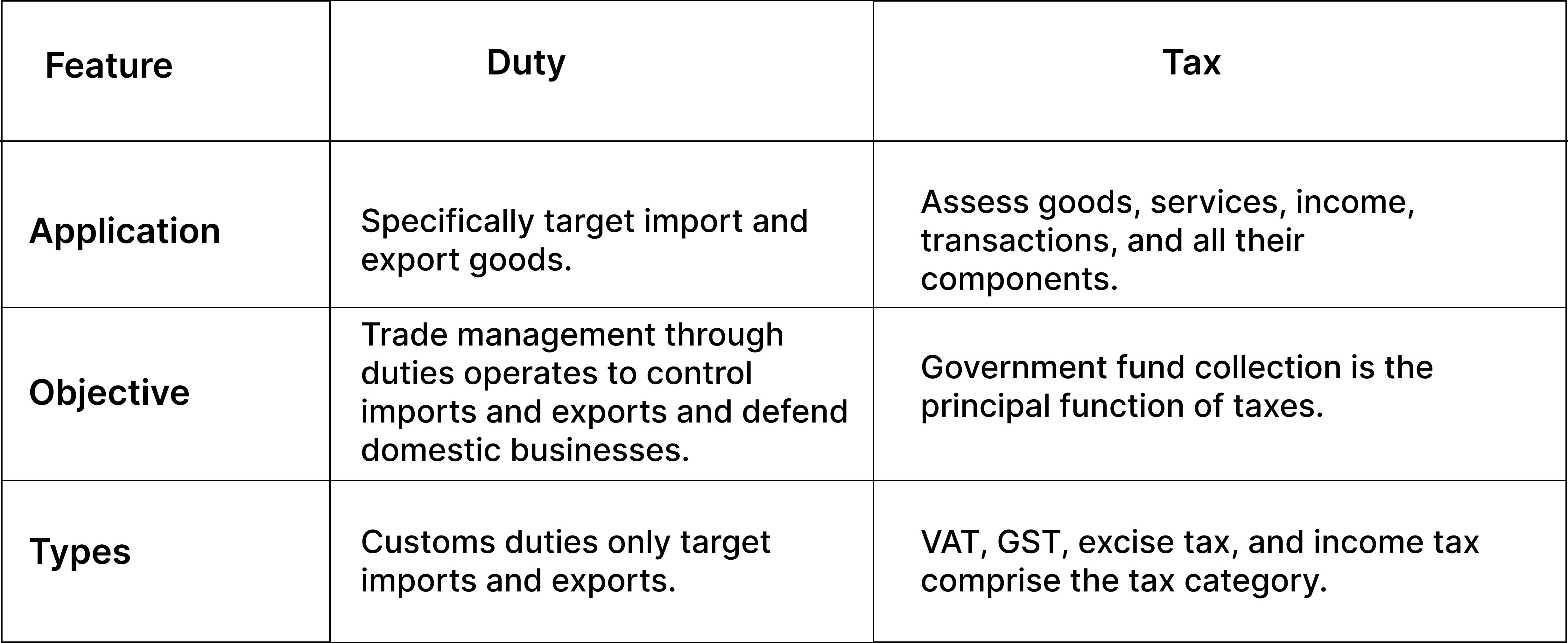

Duty vs. Tax: Key Differences

To move towards the next part of understanding duty vs tariff vs taxes, it is important to note that duties and taxes also differ in several ways:

How to Calculate Duties, Taxes, and Tariffs for Customs Compliance

To calculate duties, taxes, and tariffs accurately, follow these steps:

- Classify Goods

The first step is to obtain your goods' HS code, which determines the rates at hand for customs duties and tariffs.

- Determine Customs Value

Determine the total CIF value with costs of goods alongside expenses for insurance and freight.

- Apply Duty Rate

The calculated duty result will depend on the selected duty rate for a specific transaction.

- Calculate Taxes

Start by obtaining the proper VAT or GST tax rate and then apply the amount to both the product value and duty.

- Add Tariffs

Trade policies that trigger additional tariff payments must be added for consideration.

Example Calculation: If goods have a CIF value of $10,000, a duty rate of 5%, and a VAT rate of 10%: Duty = $10,000 x 0.05 = $500 Taxable Value = $10,000 + $500 = $10,500 VAT = $10,500 x 0.10 = $1,050

How Can Drip Capital Help?

Are you looking to simplify your international trade process? Drip Capital provides tailored trade finance solutions to help you navigate duties, tariffs, and taxes with ease. With flexible payment terms, explore trade finance options through Drip Capital’s finance solutions.

Organisations engaged in international trade must comprehend various elements of duty regulations, customs values, and tax requirements. These costs function as dual influencers of merchandise expenses while modifying both shipping approaches and adherence regulations. Businesses that correctly identify their goods for classification and calculate charges precisely while staying up to date with trade regulations can prevent costly penalties and lower operational charges.

Global trade operations experience complicated customs clearance needs, which require the use of tools beyond basic knowledge to maintain seamless transportation processes. Understanding duty vs tariff vs taxes makes it easier to move towards initiating smart decisions.

Frequently Asked Questions

1. How do I know My Customs Duty Rate?

To determine your customs duty rate, identify the HS Code for your product and refer to the tariff schedule of the importing country. You can also check if a Free Trade Agreement (FTA) applies to your goods, which may reduce or eliminate the duty. If you're unsure, consult a customs broker or freight forwarder for assistance.

2. Who pays duties and taxes?

The importer of record typically pays duties and taxes. This is usually the individual or company responsible for the shipment when it enters the destination country. Depending on the agreement between the seller and buyer, the costs may be included in the total price (Delivered Duty Paid - DDP) or paid separately by the buyer (Delivered At Place - DAP).

3. How can businesses can minimize the impact of duties and taxes?

Yes, duties are a type of indirect tax imposed by governments on goods imported or exported across borders. They are primarily levied to regulate trade, protect domestic industries, and generate revenue for the government.

4. Are duties a type of tax? 5. How do Taxes Affect International Trade?

Taxes influence international trade by increasing the cost of goods, impacting their competitiveness in global markets. High taxes can discourage imports, while favorable tax policies, such as reduced duties under FTAs, can promote trade. For exporters, understanding taxes is critical to pricing products competitively and ensuring compliance with international regulations.