Have you ever looked at a booming business and wondered, "With all this revenue, why did they run out of cash?" It might sound surprising, but having high revenue doesn’t always guarantee a healthy cash flow. Many businesses make the mistake of equating the two, only to stumble when it’s time to pay bills, restock inventory, or invest in growth.

Understanding the difference between cash flow and revenue is not just financial jargon; it’s the cornerstone of running a successful business. While revenue measures the money coming in, cash flow tracks how that money moves in and out, determining your company's ability to sustain operations. Let’s break down these two vital concepts and see how they shape your business's financial health.

What is Cash Flow?

Imagine running a café. You sell coffee worth $1,000 today, but the payments won’t hit your account until next month. Meanwhile, you need to pay your supplier tomorrow. That’s a cash flow problem!

Also Read: What Is a Cash Conversion Cycle?

Cash flow is the net amount of cash moving in and out of your business. It reflects your liquidity—how much money you have readily available to cover expenses, invest in operations, or tackle emergencies. A positive cash flow means you have more money coming in than going out, while negative cash flow signals potential trouble.

Why is it important? Cash flow determines your ability to operate day-to-day. Even profitable businesses can fail if they lack sufficient cash to meet immediate obligations. It’s the pulse of your business’s financial health.

Types of Cash Flow

Cash flow isn’t a one-size-fits-all concept. It’s divided into three main categories:

1. Operating Cash Flow

Operating cash flow measures the cash generated or used by your core business operations. This includes revenue from sales and cash spent on day-to-day expenses like salaries, rent, and utilities. For example, if a bakery sells cakes worth $10,000 and spends $4,000 on ingredients and wages, the operating cash flow would be $6,000. This type of cash flow reflects the business's ability to generate income from its primary activities.

2. Investing Cash Flow

Investing cash flow tracks the money spent on or earned from investments, such as buying equipment, upgrading facilities, or selling old assets. For instance, if a clothing store spends $20,000 on new sewing machines but earns $5,000 by selling outdated equipment, the investing cash flow is -$15,000. This metric shows how a business is allocating funds to grow or sustain operations.

3. Financing Cash Flow

Financing cash flow monitors cash movement related to funding activities, including taking out loans, issuing shares, or paying dividends. For example, a tech startup might receive $100,000 from investors and repay $20,000 of a previous loan, resulting in a financing cash flow of $80,000. This type of cash flow indicates how a business manages its capital structure and external financing.

Understanding these categories helps business owners and managers evaluate performance, identify problem areas, and make informed decisions about future financial strategies.

What is Revenue?

Revenue, often referred to as the top line, is the total income your business earns from selling goods or services. For instance, if your café sells 1,000 cups of coffee at $5 each, your revenue is $5,000.

While revenue paints a picture of your business’s earning potential, it doesn’t account for expenses like rent, wages, or taxes. It’s important to remember that high revenue doesn’t always mean profitability or financial stability. For example, a business may generate millions in revenue but still face financial struggles due to high operating costs or delayed payments.

Revenue is not a monolithic concept; it comes with several layers and terminologies that provide deeper insights into a business’s financial performance.

1. Gross Revenue

This is the total income earned from sales of goods or services without accounting for any deductions like discounts, returns, or allowances. For instance, if a furniture store sells 500 chairs at $100 each, its gross revenue is $50,000.

2. Net Sales

Net sales are derived after deducting returns, discounts, and allowances from gross revenue. It provides a more accurate picture of what a business earns from its actual sales. Using the furniture store example, if $5,000 worth of chairs are returned or discounted, the net sales would be $45,000.

3. Operating Revenue

This is revenue generated from a company’s core business activities. For a clothing retailer, operating revenue would come from selling apparel. It excludes income from secondary activities like selling old equipment or interest from investments.

4. Non-Operating Revenue

This refers to income generated from activities outside the company’s main operations. Examples include rental income, dividend payments, or gains from asset sales. While important, this type of revenue doesn’t reflect the business’s primary earning potential.

5. Operating Income

Also known as operating profit, this is the revenue remaining after deducting operating expenses like salaries, rent, and cost of goods sold (COGS). It indicates how efficiently a company is running its core operations. For example, if a bakery earns $50,000 in net sales and spends $30,000 on expenses, the operating income is $20,000.

Why Understanding Revenue Matters

Breaking down revenue into these components allows businesses to analyze their income streams and operational efficiency. For instance:

- High gross revenue but low net sales might point to excessive discounts or returns.

- High operating income signals strong cost control and operational efficiency.

By dissecting revenue with these key terminologies, businesses can make more informed decisions, spot inefficiencies, and strategically allocate resources to improve profitability. Revenue, while not the sole measure of success, is the starting point for understanding a company’s financial health.

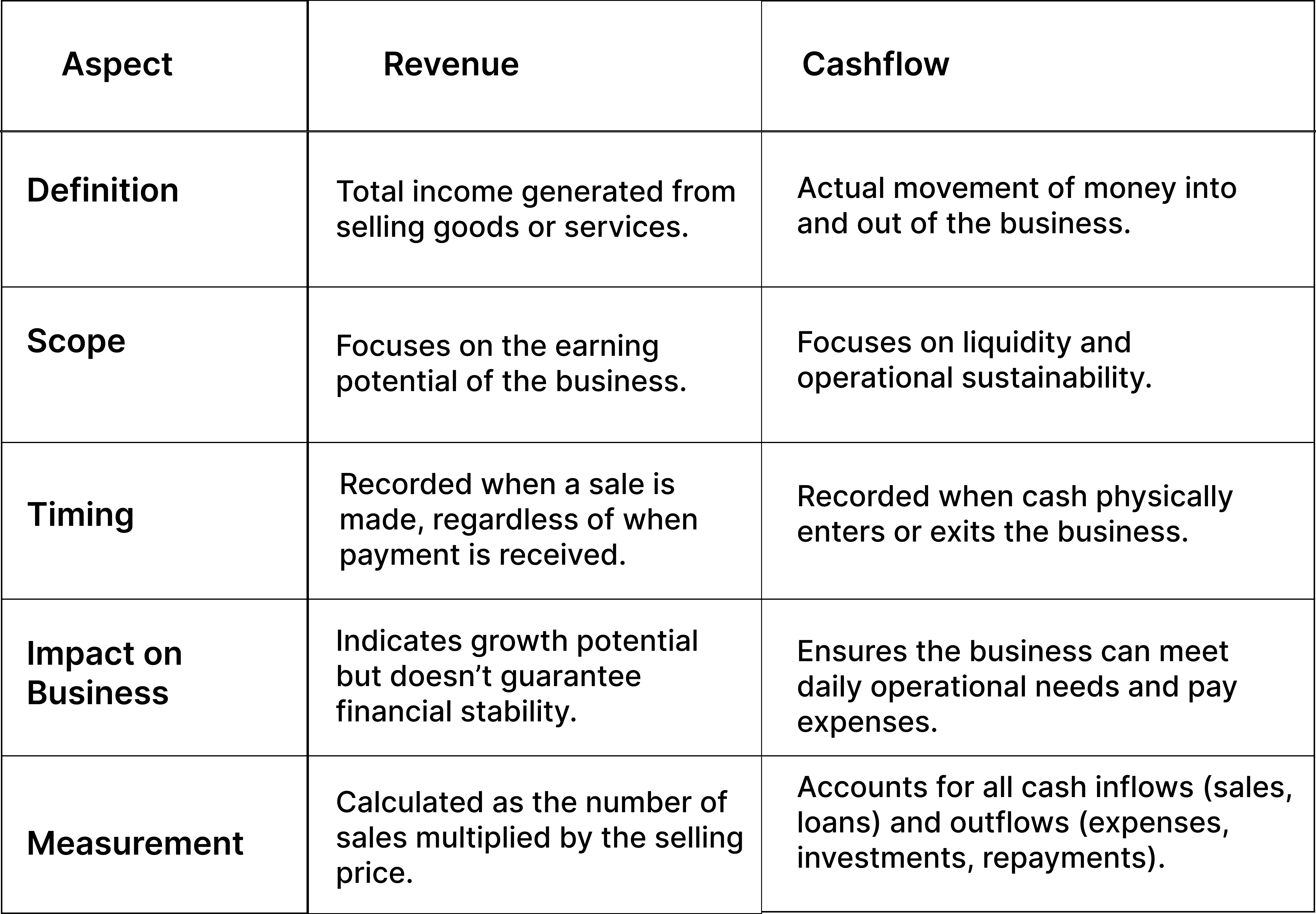

Differences Between Revenue and Cash Flow

Let’s understand with an example –

Imagine a retail business that sells smartphones. In one month, the business generates $50,000 in revenue from selling 100 smartphones at $500 each. However, the customers buy on credit, meaning the actual cash won’t come in until next month.

Despite this, the business records the full $50,000 as revenue because it reflects the total amount earned from sales, regardless of when payment is made.

On the other hand, cash flow focuses on the actual movement of money. Even though the business has $50,000 in sales revenue, it may not have enough cash on hand to cover its immediate expenses like paying the supplier $20,000, covering wages of $5,000, and paying $3,000 in rent.

Since the payments from customers are due later, the cash flow for the month could be negative, reflecting that the business may not have enough liquid funds to meet its short-term financial obligations. This shows how a business can show strong revenue but still face cash flow problems if payments are delayed.

To sum it up…

Understanding the nuances between cash flow and revenue is crucial for business success. While revenue indicates how well your products or services are selling, cash flow reveals whether your business has enough liquidity to sustain itself.

Both metrics play vital roles, but focusing on cash flow management ensures you’re not caught off guard by expenses or investment opportunities. With the right balance, you can drive your business toward growth and long-term success. So, are you tracking your cash flow and revenue effectively? If not, now’s the time to start!

Frequently Asked Questions

1. Can growth lead to cash flow problems?

Yes, growth can strain cash flow if a business expands too quickly without managing its expenses and receivables. High sales may lead to delayed payments or increased inventory costs, causing cash flow challenges.

2. Is cash flow more important than profit?

While both are crucial, cash flow is often considered more critical for day-to-day survival. A business can be profitable on paper but struggle if it lacks the liquidity to pay expenses and reinvest.

3. What is the Formula for Revenue?

The formula for revenue is: Revenue = Number of units sold x Price per unit. It reflects the total income generated from sales before any expenses are deducted.

4. Why Is Revenue Important?

Revenue is vital because it shows the business's ability to generate income, helps gauge market demand, and drives growth potential. It’s the foundation for calculating profitability and expansion.

5. How to Improve Revenue?

To improve revenue, businesses can increase sales by expanding their customer base, enhancing marketing efforts, offering new products or services, or improving pricing strategies.