A letter of credit (LC) is a financial document wherein banks act as an intermediary between a buyer and a seller to ensure the fulfillment of the transaction. The buyer asks his bank to issue a letter of credit to the seller or the beneficiary. The seller’s bank verifies the LC before he ships the goods. The seller ships the products and furnishes the necessary documents to the bank, upon which the bank pays the seller the full amount mentioned in LC.

There is a significant gap between the seller furnishing the documents to the bank and the bank processing the payment. This is because these documents are sent to the buyer’s bank and verified again. The buyer pays his bank within a grace period of 30, 60, or 90 days, based on the terms and conditions mentioned in the LC.

As the seller has to wait for 30-90 days to receive its payment, such transactions increase the risk for the business. However, with the help of LC at sight or Sight LC, he can avoid the payment default risk.

What is the meaning of LC at sight?

A sight letter of credit is a document which stands as a proof of payment in return of the goods or services to be released for the transportation by the seller. Once the goods or services reach the buyer, the buyer has to pay the financial institution that provided the Sight LC.

The process of submitting and verifying the documents is known as the sighting process, after verification the document is called the Sight LC . The banks or financial institutions generally take between 5 to 10 business days to process these documents.

How does a Sight LC work?

Here is a step by step process of how sight letter of credit works:

A buyer who needs certain goods contacts a supplier and gets a quote for the requirement, and confirms the deal.

The buyer then goes to his bank, generally, one that has already extended him a line of credit, and asks the bank to issue a sight LC towards the supplier.

After having looked at the creditworthiness of the buyer, the bank issues a sight LC and sends it to a bank in the supplier’s country.

The supplier’s bank then informs the buyer and sends them the LC along with all the terms and conditions of the trade.

Once the supplier is happy with the LC, he ships the products and submits the shipping documents to the supplier’s bank.

The bank processes the documents and sends them to the buyer’s bank.

The buyer is alerted by the bank that the documents have arrived, and he needs to make the full payment to collect the documents. The buyer will need these documents to get the delivery of the product.

The buyer inspects the documents and pays for the LC, after which the buyer’s bank sends the payment to the seller’s bank. The seller is paid for the amount, generally much before the goods reach the buyer.

LC at sight - Payment Terms

When a bank issues a sight LC, it acts as a guarantor of payment to the beneficiary. The seller has to furnish all the shipping documents mentioned under the terms and conditions in the LC to receive the payment. Once you submit all the documents and the issuing bank verifies the same, the bank releases the funds. The buyer immediately makes the full payment to the bank upon the receipt of documents.

In case the supplier is not able to provide the documents, the bank is not liable to release the payment. Furthermore, if there are any discrepancies found in the paperwork, the issuing bank can deduct a small fine from the total payment.

By now you'd have come to the realization that trade finance is a complicated subject that exporters/importers have to deal with on a regular basis simply due to the complexities involved with international trade.

At Drip Capital, we understand the plight that most importers are faced with and our competitive exporters finance products & buyer's credit products are best suited to facilitate hassle-free international transactions so you can focus on scaling your business.

In 4 short years, we've helped 2,000 + traders by disbursing more than $1 Billion of affordable credit with hassle-free documentation.

Usance LC - Payment Terms

In the case of Usance LCs, also known as deferred payment LCs, the buyer is given a grace period of 30, 60, 90, or 120 days after receiving the documents to make the payment. This is known as LC 30 days, LC 60 days, LC 90 days, and LC 120 days.

Difference between Sight LC and Usance LC

A usance letter of credit is a type of LC wherein the buyer is allowed to make the payment after the delivery, within a stipulated grace period. Unlike with sight LCs, the buyer doesn’t have to make payment immediately to receive the documents. Usance LCs generally provide a buffer of 30, 60, 90, or 120 days to make the payment. A usance LC is also known as a deferred payment LC, or a term LC.

What is the meaning of Usance LC ?

A Usance or a Deferred Letter of Credit; means that even after the buyer has received the goods or services the buyer gets a grace period to do the payment to the financial institution or the bank i.e 30, 60, 90 or more days as per agreed during the process.

An Example explaining Sight LC

A cold drink company called A in the US wants to buy one million bottles for their product. They identify a manufacturing company B in Singapore and contact them with their requirements. The manufacturer gives them the total cost and upon agreement, asks the buyer to make an advance payment as security before beginning production. However, the buyer does not want to take the risk of paying in advance and then not receiving the goods.

In such a scenario, both parties agree to hedge the risk via the ‘sight letter of credit’ payment method. The parties agree to all the terms and conditions under which the trade is to take place. Company A goes to his bank, which is a well-known financial institution in the US and asks them to issue a sight LC to the supplier -- company B in Singapore. The LC should contain all the agreed-upon terms and conditions.

The buyer’s bank issues the sight LC and sends it to the supplier bank in Singapore. Then the bank sends the LC to the supplier, who further examines the document and starts the production process. Once the production is complete, the supplier ships it and submits the shipping documents like the bill of lading and packing bill to the bank in Singapore for examination. The bank checks the documents for any discrepancies and forwards them to the buyer’s bank in the US.

The buyer’s bank checks the documents, and once they are satisfied, it asks the buyer to pay the LC amount at sight to collect the document. Since the bank has issued a sight LC, the buyer, i.e. company A, cannot collect the documents without paying the LC amount upfront. Without it, the buyer cannot receive the goods shipped by the supplier. Once the buyer pays the amount and collects the documents, the bank sends the money to the nominated bank in Singapore. The bank in Singapore eventually transfers the money to the beneficiary.

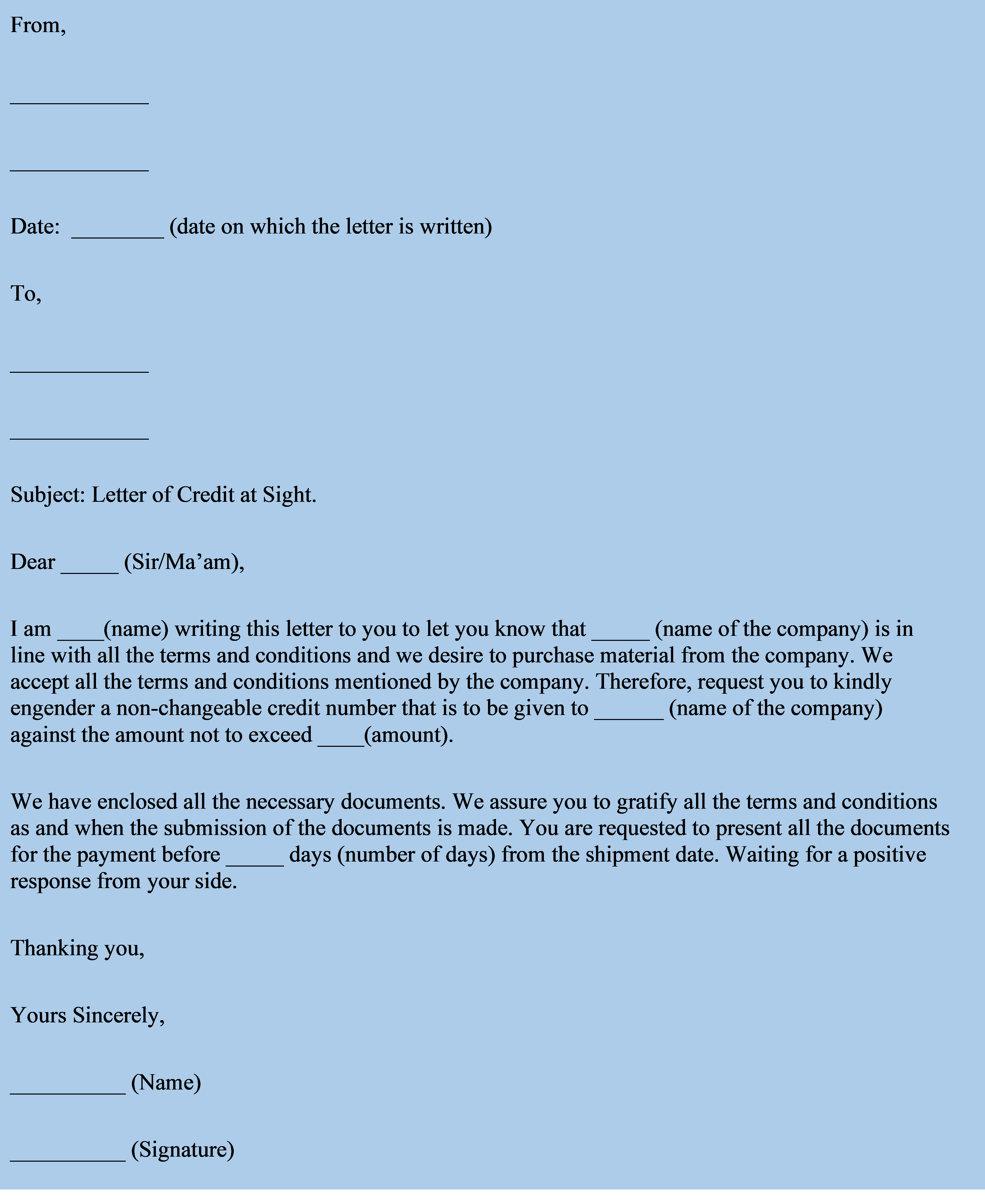

Sight LC - Format

FAQs on Sight LC

1. What is LC margin?

When a bank issues an LC, it asks for collateral that is worth some fraction of the actual LC amount. This percentage is known as LC margin.

2. Is LC at sight safe?

A sight LC is one of the safest modes of transactions as the issuing bank and the confirming bank both act as a guarantor to honor the agreement.

3. How are the LC opening charges calculated?

Opening charges are generally 0.125% of the total value of the LC. They are levied from the date of issuance until the LC expires or is paid for.

4. Can sight LC be discounted?

Sight letters of credit should not require any discount mechanism as issuing banks or confirming banks must honor at sight credits as soon as they determine that the beneficiary’s presentation is complying.

5. What is the maturity date for Sight LC?

Sight LC matures on the date on which the documents are submitted to the bank by the beneficiary.

6. Can sight LC be negotiated?

Yes, both- sight, as well as usance LCs, can be negotiated.

7. What is the limit of LC at sight?

Sight LCs are cleared by the bank within 5 to 10 working days.

8. Can sight LC be confirmed?

Sight LCs are confirmed both by the issuing bank (buyer’s bank) and confirming bank (seller’s bank). Both the banks have to honour or negotiate the LC, once they receive the documents.