If you are planning to a new business, you have to first create a business entity which is legitimate in the eyes of the law. The type of business entity you choose will totally depend on various factors that include the size of the business, number of stakeholders, compliance costs and effort and acceptability in targeted markets.

Guidelines for a Company/Firm

- The shareholders of the company take a unified decision on the appointment of a director. According to the Companies Act, any individual can be a director of the company.

- While the question of appointing a lawyer/CA/CS remains apprehensive, the procedure does not demand any legal suits but one can go for it if completely unaware about the procedure.

- Likewise, the option of a business without registration still holds a prerogative in operating concerns, but one can avail government credentials only with a registration procedure.

- Also in India, a business with a savings account has restrictions to narrowing the number of transactional payments.

- Limiting it down to the name of a company -- a company needs to be very specific in law. The name of a company can be changed only after a term period of three years.

Types of Business Registrations in India

There are different types of businesses entities relevant in India which include - Sole Proprietorship, Partnership, Companies, and many more.

Let’s have a look at the various export business entities you can potentially create:

How to Register a Sole Proprietorship?

A Sole Proprietorship is the easiest business entity to establish and operate, and its compliance, too, is relatively easy. Owner of the business generally signs a contract in his or her own name, as he/she has no separate/independent existence under law. Also as the owner of the business, he/she will be responsible for its liabilities, however the concerned party can also avail of the benefits of Sections 80C to 80U of the Income Tax Act.

Documents required to register a Sole Proprietorship

- PAN Card

- Aadhaar Card

- IEC Code

- Bank Account statement

- Cancelled Cheque

- GST registration

- Registered Office Proof

Steps involved in registering a Sole Proprietorship

- Application for the Pan Card

- Selection of the company name

- Purchase of a domain

- Opening a bank account (in the business name)

- Business License from particular city/country

- Registration with the state taxing authority (is case of taxable products)

- EIN Number (in case you wish to hire an employee)

- Insurance coverage (for risk and safety measures)

Note: Your business will be taxable once its total income crosses the minimum threshold to fall under the various income tax slabs.

How to Register a Partnership Firm?

Under the Indian Partnership Act 1932, a firm may be registered at any time by filling in an application with the Registrar of Firms. While the registration has its advantages, it is not compulsory for the parties to get a firm registered.

The maximum number of partners in a partnership firm holds a limit of 20. Partnership is a convenient entity to form when more than one business partner plans to come together for business purposes. However, similar to a Proprietorship, as a partner, you will remain personally liable for the company, unless it is a Limited Liability Partnership.

A Partnership deed is the primary document required for a Partnership firm, and its submission is compulsory for registration of the firm. Depending on the size and type of business, Partnership firms need to comply with a few regulations such as GST, TDS, ESI, PF norms, and others. Partnership firms will also have to undergo income tax assessment and audits.

Also read : What is Export Credit Insurance and How does it works ?

Documents required for partnership firm

- Partnership Deed

- PAN Card

- ID Proof ( Any one of the following -- Aadhar Card, Passport, Electricity Bill, Driving License, Telephone bill, Mobile bill,)

- Firm address

- Documents of Partners

- GST registration (for GST registration of partnership firm)

- Bank Account details -- a copy of bank statement and a cancelled cheque

Steps involved in registering a partnership firm

- Decision of Partners to come together and form an entity

- Types of Partner (general, limited, equity, salaried)

- Profit sharing ratio among the partners

- Name and Address of the firm as well as all the partners

- Nature of business

- Duration of Partnership (whether for a fixed period/project)

- Capital contribution by each partner

- EIN Number (employer ID number)

- License and permits

- Commencement of business

How to Register a Limited Liability Partnership (LLP)?

LLP is one of the most popular business entities nowadays, primarily because of its universal acceptance and the dual benefits of a company setup and partnership that it offers.

There is no limit on the maximum number of partners in an LLP, unlike the 20-partner limit in a Partnership or 200-member limit in Private Limited Companies. Also the cost for registering an LLP is slightly higher as compared to the partnership firm, as the opportunity to have an entity which has benefits of a company such as limited liability for partners make LLP a popular business entity.

The income tax applicability for an LLP is the same as a Partnership. The audit of LLP accounts is not compulsory up to a specific turnover or contribution. However, as LLPs are closely monitored by the Ministry of Corporate Affairs, the compliance norms for LLPs are stricter.

Documents required to register a LLP

- ID Proof, Address proof & Residence Proof of all the partners

- Passport sized photographs of all the partners

- Proof of Registered Office Address of the LLP

- Digital Signature Certificate

- PAN Card of all partners

- GST Registeration

- Current Account Details

LLP is quite popular and well suited for export businesses. If the business the LLP is getting into involves exports then it should also get the following documents:-

- IEC Code (IEC) (to be obtained from the Director-General of Foreign Trade)

- Registration cum Membership Certificate (RCMC) (to be obtained from the relevant Export Promotion Council/Commodity Board/other authorized agency like the Federation of Indian Export Organizations)

Steps to register an LLP

- DPIN: All partners have to apply for the Designated Partner Identification Number (DPIN) by filling the e-form DIR-3 (Fig. 1 below). However, if you have a Director Identification Number, it can also be used as a DPIN. In case you are a first-time user, you will have to register yourself as a user in the relevant user category.

Fig. 1: e-form DIR-3

Fig. 1: e-form DIR-3

Digital Signature Certificate: All filings done by an LLP must use Digital Signatures. A Digital Signature Certificate (DSC) can be acquired from a licensed certifying authority.

MCA Registration: The obtained DSC has to be registered with the LLP application in the portal of the Ministry of Corporate Affairs.

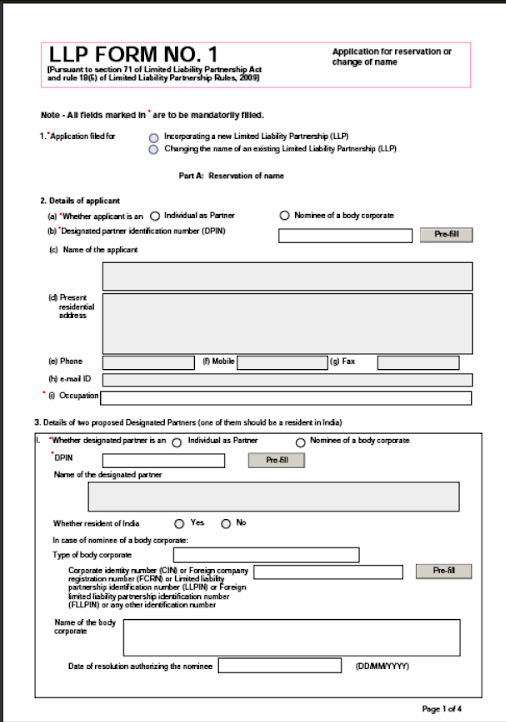

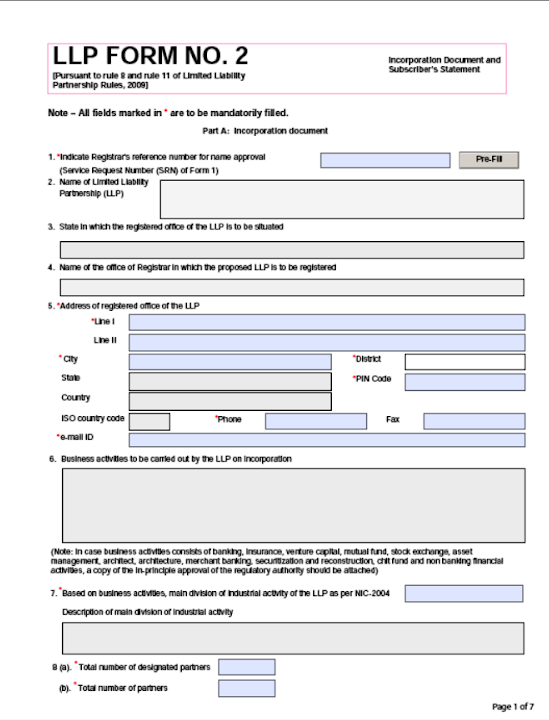

Form 1 & 2: To register the name of the LLP, you have to fill Form 1 (Fig. 2 below). Post this, you need to fill the Form 2 (Fig. 3 below) to get the LLP incorporated. Once approved on the system, the status of the form will appear as “Approved”.

Fig. 2: Form 1 for LLP name registration.

Fig. 2: Form 1 for LLP name registration.

Fig. 3: Form 2 for LLP incorporation.

Fig. 3: Form 2 for LLP incorporation.

- Form 3: Within 30 days of incorporation, an initial LLP agreement has to be filed with Form 3 (Fig. 4 below).

Fig. 4: Form 3 - Initial LLP Agreement

Fig. 4: Form 3 - Initial LLP Agreement

Post the completion of these steps, the LLP is ready to start functioning as an export business.

How to Register a Private Limited Company

Private Limited Companies are separate legal entities with perpetual existence and limited liability. A Pvt Ltd Company has to have at least two directors and a maximum number of shareholders is restricted to 200 members. A Private Limited Company can have a large number of shareholders and the power to own material goods, enter into a contract, borrow, and even fight legal disputes as an entity in itself. With a Pvt Ltd Company you can also raise funds from investors instead of relying on banks for financing.

The minimum capital needed to establish a Pvt Ltd Company is Rs. 1,00,000, while there is no such requirement for establishing an LLP. Pvt Ltd Companies need to abide by various guidelines such as a quorum for meetings and a cap on maximum managerial remuneration, amongst others.

Documents required to register a Pvt. Ltd Company

- Passport Size photo

- Aadhar Card

- Pan Card

- ID Proof

- DIN (Director Identification Number)

- NOC (No objection Certificate)

- Affidavit on a Stamp Paper

- Utility Bills (that are not older than two months)

- Office Address

- Board Resolution/Letter of Consent (in case if any stakeholder is a body corporate and not an individual)

Steps to start a Private Limited Company

- Obtain Digital Signature Certificate (DSC)

- Apply for DIN (Director Identification Number)

- Selection of name for the proposed company

- Draft MOA (Memorandum of Association) and AOA (Articles of Association) of the proposed company

- PAN and TAN application

- Stamping, digitally signing and e-filing of various documents with the Registrar of Companies

- Payment of Fees to ROC

- Obtain Certificate of Incorporation

How to Register a Public Limited Company?

The listing of a company on a stock exchange paves the way for higher fundraising opportunities by having unlimited members and inviting the public to purchase shares. This is beneficial if the company produces capital-intensive goods or services, and hence requires a significant amount of funds.

A Public Limited Company has compulsory statutory meetings and a higher minimum share capital requirement of Rs 5 Lakhs. Furthermore, a public company has high compliance requirements. Public Limited has a limit on listing the members and shareholders in the company. Public Companies must have minimum 7 Shareholders and 3 Directors which is higher than a Pvt Ltd Company.

Documents required for registration a Public Limited Company

- Pan Card

- Aadhar Card

- Identity Proof

- Address Proof (of all directors and shareholder)

- Registered Office Addres

- NOC (No Objection Certificate)

- MOA/AOA

- DSC (Director Identification Number)

- DIN (Digital Signature Certificate)

Steps to start a Public Limited Company

- Obtain Digital signature certificate (DSC)

- Apply for DIN (Director Identification Number) for all the proposed directors

- Selection of name of the proposed Public Limited Company

- Application to Registrar of Companies (ROC) along with the required documents like MOA, AOA, duly filled Form DIR – 12, Form INC – 7 and Form INC – 22

- Payment of registration fees to ROC

- Apply for the Certificate of Commencement of Business.

How to Register a Co-operative Society?

Establishing a cooperative society is ideal for exporting certain types of products such as agricultural products, handicrafts and other cottage industry-related items. Government departments such as the Maharashtra State Agricultural Marketing Board often support farmer’s cooperative societies.

Cooperative societies are taxable under the Income Tax Act, however, they are eligible for various deductions and exemptions. Cooperative societies carrying out business activities are required to maintain books of accounts and get their accounts audited annually.

Documents required for a Co-operative Society

- Pan Card

- Aadhar Card

- List of promoter members

- Copy of proposed bye-laws of the society

- Proof of registration charges

- Address Proof

- Utility Bill

- Bank Statement

- MOA/AOA

Steps involved in the Co-operative society Formation

- Listing the member (a minimum of 10 members required)

- Naming the main member

- Selecting the name for the co-operative society

- Application to be made to the registration authority

- Submission of bank account details

- Authority will then process it to the government

- After acknowledgment the certificate will be issued.

How to Register a Hindu Undivided Family (HUF)

If your export business is being promoted by you and your family, the Hindu Undivided Family (HUF) is an option worth exploring. With a HUF, the business is kept within the control of the family. Additionally, by opting for a HUF instead of a proprietorship, you can get additional tax exemptions.

An HUF consists of a Karta -- that is the oldest male who is the head of the family -- who is assessed for income tax as the head of the HUF and it has Co- Parceners which can be any member of the family who have the right to demand for the share of property (a person holding the authority to ancestral property i.e. son, daughter, grand children etc). The HUF is a separate legal entity and can get a tax exemption of Rs. 1.8 lakh per year.

Documents required for the HUF registration

- Photograph of the Karta

- Deed of declaration

- List of Coparceners

- Proof of identity

- Address Proof

- Pan of HUF

- Bank statement/pass-book

Steps required for HUF registration

- Mention the Karta and Co - Parcenors

- Selecting a suitable name

- Create a HUF deed

- Apply for HUF pan Card

- Open a bank account in the name of HUF

Registering a business name can be challenging when it comes to formation of a new company/firm. Whichever type of business entity you decide to establish, once you have a legally recognized entity with a Current account, IEC Code, and other mandatory documents and registrations in place, you are ready to start your export business.

Also Read: How to Select Product for Export

Pro Tips

Consider the types of business and their feasibility for your needs thoroughly before picking one.

Consider the manpower you have and the compliance cost and effort required.

Conventional wisdom says that PLC and LLP formats are more popular because of their international prevalence and relative ease of running.

Remember, you can always change your business type -- from a Partnership to LLP or from a PLC to a Public Company -- as your business grows and evolves.

Warnings

Check the merits and challenges of being personally liable for your business, and what it means, before choosing the Proprietorship or Partnership models.

Keep your target geography in mind -- for example, will your importing country understand the HUF model?

Make sure you don’t miss out on export-related benefits because of not choosing one business type over another. Check government sources and websites thoroughly and be sure to take professional legal advice before finalizing the right business form for your needs.