In August of 2000, the Government of India and the Small Industries Development Bank of India (SIDBI) formally launched the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme.

The funds for the CGTMSE scheme are contributed by the Government and the SIDBI in a ratio of 4:1, respectively.

What is the CGTMSE Scheme?

CGTMSE scheme is a financial support initiative implemented by the Government of India to facilitate easier access to credit for micro and small enterprises (MSEs).

It is a trust established to implement the Credit Guarantee Fund Scheme for Micro and Small Enterprises.

The government initiated this credit guarantee scheme to provide collateral-free credit to MSEs.

It encompasses both existing and new enterprises eligible for coverage under the scheme.

What is The Objective of the CGTMSE Scheme?

The primary objective of the CGTMSE scheme in India is to facilitate improved access to credit for micro and small enterprises (MSEs).

The credit guarantee scheme also aims to:

- Enhance credit flow: By mitigating the risk of defaults through the credit guarantee cover, the scheme aims to enhance the flow of credit to MSEs.

This gives MSEs the necessary funds to meet working capital and investment requirements.

- Promote collateral-free credit:

The scheme promotes collateral-free credit by reducing the requirement of tangible collateral or third-party guarantees.

It also encourages lending institutions to extend credit to MSEs by providing them with a credit guarantee cover.

- Foster entrepreneurship and support sustained growth:

By encouraging individuals to establish and expand their own enterprises and providing them with easy access to credit, the scheme extends support for the growth and development of MSEs.

This, in turn, leads to employment generation, income generation, and overall economic development.

Who is Eligible for the CGTMSE Scheme?

The eligibility criteria for the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme are as follows:

Eligible Debtors

Both new and existing Micro and Small Enterprises (MSEs) units such as Individuals/ Proprietorships, LLP, Partnerships, Private Limited Companies or registered companies are eligible.

MSEs operating in the manufacturing and service sectors are eligible excluding Agriculture, Self Help Groups (SHGs), etc.

Eligible Lenders

Commercial banks, chosen Regional Rural Banks, certain State Financial Corporations, NBFCs, SFBs are eligible to lend financial assistance.

SIDBI, NSIC, and NEDFI have also been added to the list of institutions that are eligible to lend.

CGTMSE Scheme Highlights 2023

Nirmala Sitharaman, Finance Minister of India, in her budget 2023 speech, announced the changes for the credit guarantee scheme.

The changes are as follows:

Rs 9,000 crore will be infused into the corpus of the CGTMSE scheme, effective from April 1, 2023.

Additional collateral-free credit of Rs 2 lakh crore will be available for MSEs

The cost of credit will be reduced by 1%.

MSEs seeking guarantee cover under the scheme for collateral-free credit will have to provide their Udyam Registration Number (URN).

Microfinance Institutions (MFIs) will be added to the member lending institutions (MLIs) list.

Features of the CGTMSE Scheme

The features of the CGTMSE scheme are:

For defaulted principal loan amounts up to Rs. 50 lakh, guaranteed repayment of 75% or 85% (in certain cases) is provided.

Loan amounts greater than Rs. 50 lakh but under Rs. 1 crore have a maximum guarantee of 50%.

Micro-enterprises with loans up to Rs. 5 lakhs receive an 85% repayment guarantee.

If the MSE is promoted by a woman or is located in the North East Region (NER), the guarantee amount for repayment is 80% of the loan amount.

The repayment procedure or CGTMSE loan recovery covers the entire loan amount, including the interest component, __for a period of 3 months __or the entire outstanding loan amount with accrued interest, whichever is lower.

This is calculated from the suit filed date or the day when the loan turns into a non-performing asset (NPA).

- In cases where the business's failure is beyond the management's control, rehabilitation support is provided to the lender to the extent of Rs. 1 crore to assist in resuscitating the enterprise.

What is the Benefit of CGTMSE Scheme?

SMEs and MSEs make up approximately 10% of India's GDP and are estimated to employ around 70 million people.

Given these enterprises' challenges in accessing credit, the CGTMSE scheme significantly eliminates obstacles and enables lenders to be more flexible in extending credit facilities.

Some of the benefits of the CGTMSE scheme include:

1. Collateral-Free Credit:

MSEs can access loans without the burden of providing tangible collateral or third-party guarantees, making it easier for them to obtain credit.

The scheme encourages lending institutions to extend credit by providing a credit guarantee cover that mitigates any risks.

2. Enhanced Loan Amount and Coverage:

The scheme has raised the ceiling for guarantee coverage from Rs. 200 lakh to Rs. 500 lakh, allowing MSEs to access higher loan amounts.

This increased coverage ensures that a broader range of enterprises can benefit from the scheme.

3. Lower Overall Cost of Borrowings:

The CGTMSE scheme has reduced the guarantee fee, which diminishes the overall cost of borrowings for MSEs.

This reduction in fees helps in making credit more affordable and accessible to MSEs, facilitating their growth and development.

4. Special Concessions and Benefits:

It provides special concessions and benefits to specific categories. For example, it offers reduced guarantee fees by 10% and increased coverage to SC/STs, women, ZED-certified units, and units in Aspirational Districts by 85%.

These concessions aim to promote inclusivity and encourage the growth of enterprises from these categories.

What is the CGTMSE Fee?

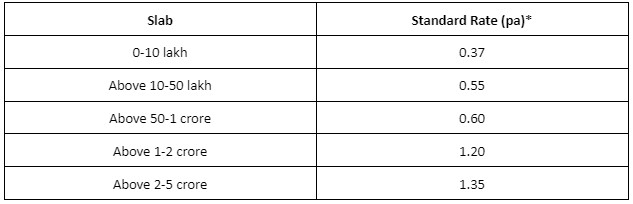

The revised Annual Guarantee Fee (AGF) structure under the Credit Guarantee Scheme, applicable to all guarantees approved or renewed on or after April 01, 2023, is provided below:

For Borrowers

For Lenders

Member Lending Institutions (MLIs) that maintain a better portfolio will receive a 10% discount on the standard rate.

Conversely, MLIs with a higher associated risk will be subject to a maximum risk premium of up to 70% of the standard rate.

What is the Limit of the CGTMSE Scheme?

Under the CGTMSE scheme, the guarantee cover is limited to a maximum credit amount of Rs. 500 lakh, even if the credit extended to an eligible borrower exceeds this amount.

This scheme’s maximum exposure to credit risk is limited to Rs. 375 lakh, which is equivalent to 75% of the defaulted amount.

What is the Coverage Criteria of CGTMSE?

The coverage criteria of CGTMSE are as follows:

For Micro Enterprises

- For guaranteed credit facilities up to Rs 5 lakh, the maximum coverage is 85%.

- For those above Rs 5 lakh and up to Rs 50 lakh, the maximum coverage is 75%.

- For guaranteed credit facilities above Rs 50 lakh and up to Rs 500 lakh, the maximum coverage is also 75%.

For MSEs located in the North East Region (including the Union Territories of Jammu & Kashmir and Ladakh)

- Guaranteed credit facilities up to Rs 5 lakh and above upto 50 lakh have maximum coverage of 80%.

- For guaranteed credit facilities above Rs 50 lakh and up to Rs 500 lakh have maximum coverage of 75%.

For women entrepreneurs, SC/ST entrepreneurs, MSEs situated in Aspirational Districts, ZED certified MSEs, Person with Disability (PwD), and MSEs promoted by Agniveers

- Irrespective of the range of guaranteed credit facilities, their maximum guarantee coverage is 85%.

For other borrowers

- Irrespective of the range of guaranteed credit facilities, the maximum guarantee coverage for them is 75%.

Process of Getting an MSE Loan Under CGTMSE

The steps to getting an MSE loan under the CGTMSE scheme are as follows:

1. Formation of business entity

Prior to initiating the loan approval process under the CGTMSE, the borrower is required to establish a legal entity such as a private limited company, limited liability partnership (LLP), one-person company (OPC), or a proprietorship, depending on the nature of the business.

They must also obtain the necessary approvals and tax registrations to proceed with the project.

2. Preparation of business report

Borrowers are then required to conduct a market analysis and develop a comprehensive business plan.

The plan should include essential information such as the business model, promoter profile, projected financials, and other relevant details.

This report is submitted to the credit facility with the loan application.

3. Sanctioning of the loan from the bank

The loan application submitted to the bank typically includes details regarding the credit terms and working capital requirements.

Once the application and business plan are processed, the bank thoroughly assesses the business model's feasibility.

Based on their internal policies, the bank then proceeds to analyze the loan application and sanction the loan.

4. Obtaining the guarantee cover

Once the loan is sanctioned by the bank, the bank will proceed to apply to the CGTMSE authority to obtain the guarantee cover.

If the loan application is approved by the CGTMSE, the borrower will be required to pay the applicable guarantee fee and service charges.

The CGTMSE loan application form can be downloaded from the official website of CGTMSE.

Note: CGTMSE does not provide loans, credit facilities, or subsidies. It also does not have any loan agents or agencies involved in arranging loans or credit guarantees through its MLIs.

Under the CGTMSE scheme, there is an extensive list of Member Lending Institutions (MLIs) consisting of 141 banks, which includes major rural, urban, public sector, and private sector banks in India.

Prominent banks like the State Bank of India, the United Bank of India, the Punjab National Bank, and others are part of this comprehensive list.