What are Export Payment terms?

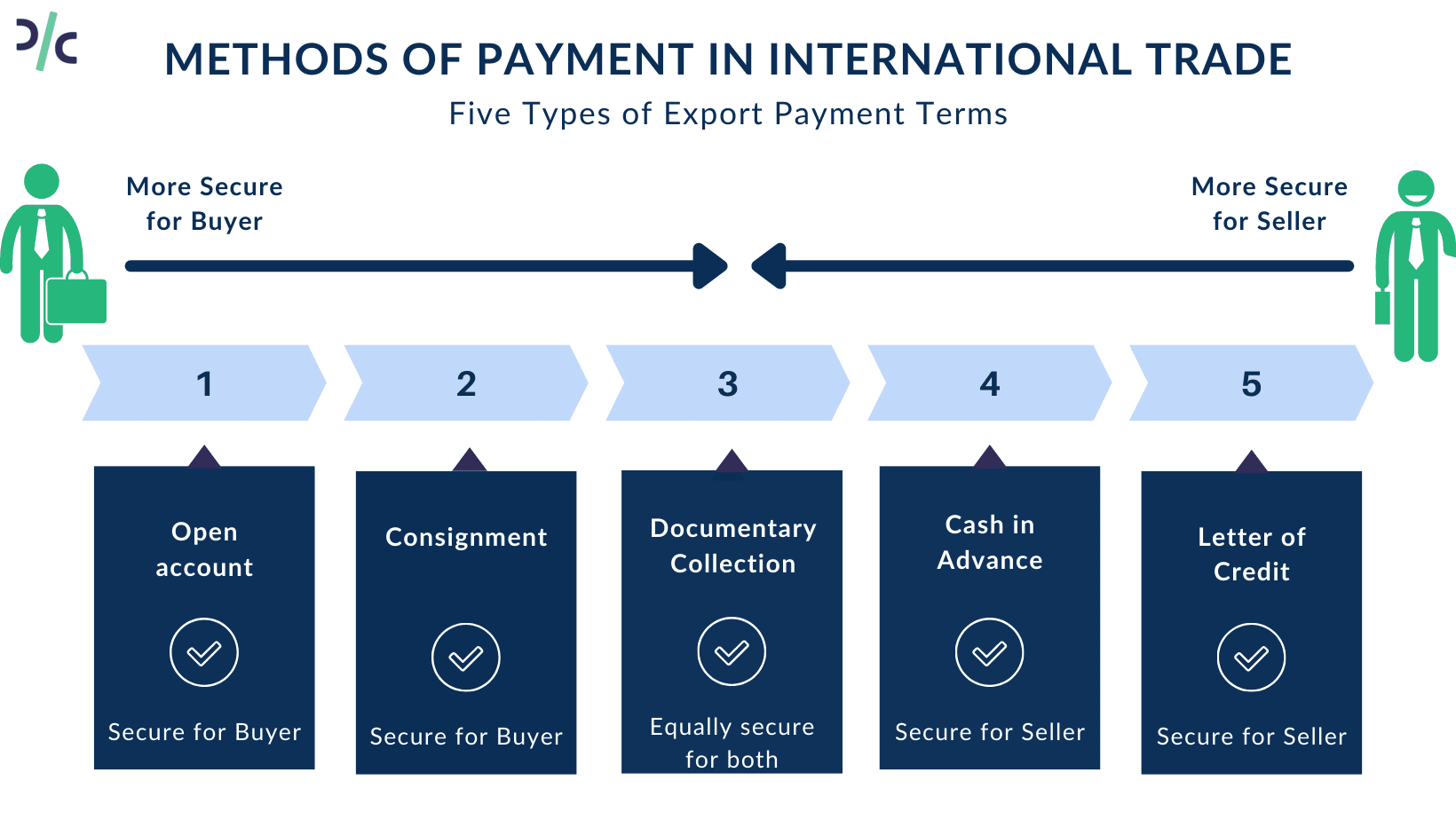

Export Payment Terms are a crucial part of International Trade, based on which exporters and importers decide how the final payment is to be processed. It's up to the two parties to decide or negotiate these terms.

There’s always a risk involved when it comes to the recovery of invoice amounts; and in cases of exports, the risk is even higher due to the physical distance between the two parties and diversities in the legal structures of the two countries.

To minimize the risk and facilitate the process different types of payments are made available to importer and exporters by which they can enter into mutual agreements. Some payment methods are more favorable for the buyer and some are more favorable for supplier. What export terms will they transact with, depends upon the trading history and relationship between the two parties.

How many Types of Payment terms are there in Export?

There are 5 types of payment terms and conditions in export. They are as follows:

- Open Account

- Documentary collection

- Letter of Credit

- Cash in Advance

- Consignment

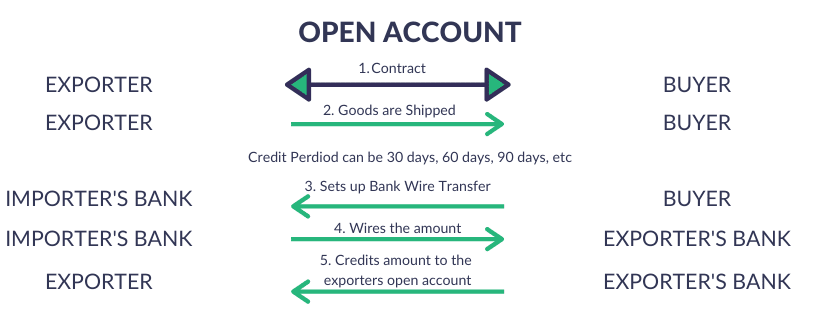

Open account

Open account payment in International Trade, the buyer receives the goods shipped by the exporter and then makes the payment at the end of an agreed credit period. The credit period can be a fixed duration – 30 days, 60 days, 90 days, etc. There is a gap between the date of receipt of the purchase order and the date of receipt of payment, with activities like production and shipping to be concluded in between.

The time gap involved in this method puts a burden on the working capital situation of the exporter. Nevertheless, the exporter may choose to opt for this payment method if the importer is a strong player with prospects of high volumes in the future. An exporter may also agree to an open account payment mode if there is a trusted relationship between the two parties, or if the amount of money at stake is negligible.

Documentary collection

In this payment method, both parties involve their respective banks to complete the payment. The remitting bank represents the exporter while a collecting bank works on behalf of the buyer. Once the exporter ships the goods, they can submit the shipping documents and a collecting order to the remitting bank, who in turn will send these to the collecting bank along with the collection instructions. This is then passed on to the buyer, on whose payment the collecting bank transfers the amount to the remitting bank. Finally, the exporter receives the amount from the remitting bank. Documentary collection may be ‘at sight’ or after a time-lapse.

There are 2 types of Documentary Collections:-

a) Cash Against Documents / Document against Payment (D/P)

CAD payment term / DP in export, happens when the buyer needs to pay the amount due at sight. This payment is made before the documents are released by the buyer’s bank (collecting bank). It is also known as sight draft or cash against documents.

b) Document Against Acceptance

DA payment term in export, is an arrangement where the buyer is required to make the payment only after a specific duration. In this mode, the buyer accepts the time draft and makes a promise to pay. Once this acceptance is received, the bank can release the documents to the buyer.

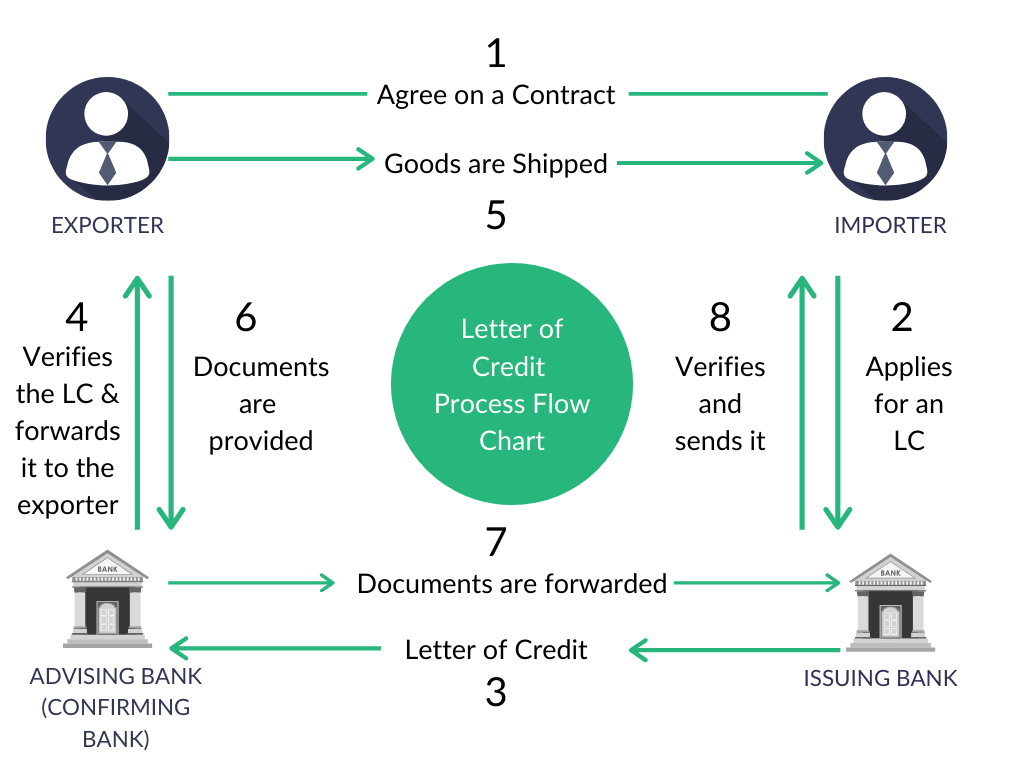

Letter of Credit

This is a safe and common international trade payment mechanism. The buyer’s bank gives a written commitment to the seller, called a Letter of Credit. It is an assurance to the exporter that the buyer’s payment will be settled as per the agreed timeline and will be subject to the agreed terms and conditions.

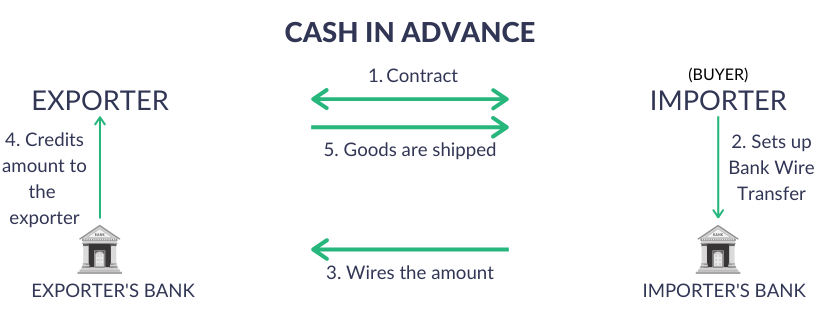

Cash in Advance

This is by far the safest & the best mode of payment term in international trade for the exporter, in which they ship the goods to the buyer only after the receipt of payment from the buyer. Depending on the terms agreed upon, the payment may be full or partial. However, since in this case the buyer takes on the bulk of the risk associated with the transaction, most importers are unwilling to enter into cash-advance agreements.

Consignment

Consignment method of payment in International Trade is a variation of open account in which payment is sent to the exporter after the goods have been sold by the foreign distributor to the end customer. The key to succeed in exporting on consignment is to partner with a reputable and trustworthy foreign distributor or a third-party logistics provider. Appropriate insurance should be in place to cover consigned goods in transit or in possession of a foreign distributor as well as to mitigate the risk of non-payment.

Role of RBI in Export Payment Terms

The Reserve Bank of India (RBI) plays an important role in regulating export payment terms in India. The RBI sets guidelines for export financing, including the types of financing that are allowed and the terms and conditions that must be met. It also monitors the foreign exchange market to ensure that exports are being paid for in a timely manner and that there are sufficient foreign exchange reserves to meet the needs of exporters. Additionally, the RBI can impose restrictions on export financing in order to prevent foreign exchange shortages and protect the value of the Indian rupee.

How to reduce Credit Risks?

Timely receipt of the sale proceeds is the biggest concern for an exporter once they ship the goods to the port of destination. Though credit risk is inherent in the export industry, there are a few steps that one can consider to reduce it.

- Export credit risk can be minimized by selecting the right mode of payment. As is apparent from the above payment modes, the cash advance is the safest payment mode for the exporter while an open account is the riskiest. Selecting the appropriate mode is often a business decision, but the risk element must be given due consideration.

- Another important safeguard against credit risk is the drawing up of a written contract that can be used to resolve any future differences. The Export Credit Guarantee Corporation (ECGC) offers various credit guarantees against payment defaults by the buyer. In the actual event of a payment default, the exporter can claim the bad debt from the ECGC, which has the power to blacklist such defaulting buyers, jeopardizing their future trade prospects of export payment terms in India.

Note:- In India, the RBI does not have a direct role in regulating terms of payment in export. But since the exchange control regulation plays a vital role, any variation in the rule will require the RBI's approval.

- The exporter must acknowledge the fact that every country has its own set of rules and business norms. They should try to understand this, and the export contract drafted should be consistent with these norms.

- If the buyer refuses to pay, the exporter can try to recover the amount by contacting the embassy of the buyer’s country or any other diplomatic presence the country has in India. The exporter should try to develop a local network in the target country so that in case of defaults a local contact can be used to follow up with the defaulting buyer. The exporter can also take the help of international collection agencies to ensure better recovery efforts. Legal action can be expensive and won’t make sense unless the amount at stake is significantly high. Arbitration agencies, such as the International Chamber of Commerce, are a more economical way of settling payment disputes.

Also Read:

- Export Logistics and its Process explained with a Flowchart

- Working Capital Loan | Meaning, Process, Types & more

- Overdraft Facility | What is it & How does it work

- Forex Hedge | Currency Hedging Strategy for Exporters

- Export Incentives in India | Types, Benefits & How it works

- Export Pricing Strategy for your export business