What is a Permanent Account Number

Permanent Account Number, or PAN, is a 10-digit alpha-numeric unique identifier issued by the Income Tax Department to any person in the form of a laminated physical card. This is mandatory for filing one’s Income Tax Return and for all correspondence with any Income Tax authority.

Within four years of its introduction, in 1976, PAN Card was made mandatory for all taxpayers. However, the system evolved to its present form in 1995, and the mandatory requirement was enforced strictly from 1996, starting first in Delhi, Mumbai and Chennai, and then the rest of the country two years later.

At present, individuals and registered business entities, including export businesses, are required to have a PAN Card.

NSDL e-Governance Infrastructure Limited (formerly National Securities Depository Limited) and UTI Infrastructure Technology Services Limited (UTIITSL) handle the entire process of PAN allotment. You can apply for a PAN card by visiting their websites and applying online. Alternatively, you can also visit local PAN agents, obtain the form from them, and fill and submit it along with the necessary documents for a nominal fee.

How to Apply for a PAN Card for your Business

Submit PAN Application Online

To apply for a PAN card online, you need to log on to one of two links:

The landing page of the UTIITSL has separate options for Indian citizens/NRIs and foreign citizens, these options are available in the form of a drop-down menu at the start of the application itself.

In the application, you need to select the Type of Application and the Category of the Applicant. For example, if your export firm is an Indian Limited Liability Partnership, you should select the same in the drop down menu.

You will have to select the Area Code, Assessing Officer Type, Range Code and Assessing Officer Number, depending on your address and area of Income Tax Jurisdiction.

Other basic information to be added includes Name of the Applicant, Date of Incorporation, Gender, Parent’s Name, Email ID, Phone Number, Residential Address, Office Address, Aadhaar Number, Registration Number (in case of a company, partnership, LLP) etc.

You will have to mention the documents that you wish to provide as the Proof of Address, Date of Incorporation, and Identity Proof. The details you mention in the form should match the details appearing in the documents that you have provided as proof. The list of documents accepted for this purpose is mentioned here.

The Application Form will also ask about your Source of Income.

You will have to disclose the name of your representative assessee if the income tax return is to be filed by someone other than the assessee. Once the Form (49A) is filled, you have to submit the form.

The submitted form should look like the above picture. It will reflect all the information entered by you along with a declaration at the bottom of the page and spaces for your signature and photograph.

Submit PAN Application Offline

You can also get the PAN application form offline from UTIITSL PAN Agents or download a copy from the websites and fill it manually.

Payment of Fees

There is a nominal fee charged for PAN applications which can be paid through credit card, debit card, demand draft, or net-banking. At the time of publication, the charges for a PAN card (hard copy and e-copy) are a nominal Rs. 107, while that for an e-PAN card are even lower at Rs. 72.

Once you make the payment through the gateway via your preferred mode of payment, a 15-digit acknowledgement number is generated. You must note this down for future reference.

Submission of Application Form

Once your online application is accepted and payment is made, print out the filled and paid-for application form. This form will also display the 15-digit acknowledgement number. On the form, you will have to attach your photographs and sign in the space provided. This process is compulsory even for an offline/hardcopy application.

Documents required along with Application Form

Some supporting documents have to be submitted along with the application form depending on the category of applicant. Depending on the type of business following are the list of documents required for your application.

Documents required for a Proprietorship Firm

Since proprietorship is not a separate legal entity, the PAN of the proprietor is considered as PAN for the Proprietorship Firm. A Proprietor or an Individual needs to submit:

- Proof of Identity

- Proof of Address

- Proof of Date of Birth

Documents required for a Company

To get your Company’s PAN Card you will need a Copy of Certificate of Incorporation issued by the Registrar of Companies (ROC).

Documents required for a Partnership Firm

To get a PAN Card for your Partnership Firm you will need:

- Copy of Partnership Deed

- Certificate of Registration issued by Registrar of Firms

Documents required for a Limited Liability Partnership (LLP)

For a Limited Liability Partnership you will need:

- Copy of Partnership Deed

- Certificate of Registration issued by Registrar of Companies

Additionally, if you opted for a demand draft as your preferred mode of payment, you will have to include the counterfoil as part of your submission documents.

You have to send the set of documents to the NSDL/UTIITSL office within 15 days of submitting the form online.

Also Read: How to open a current account for exports?

Processing and Receipt of PAN

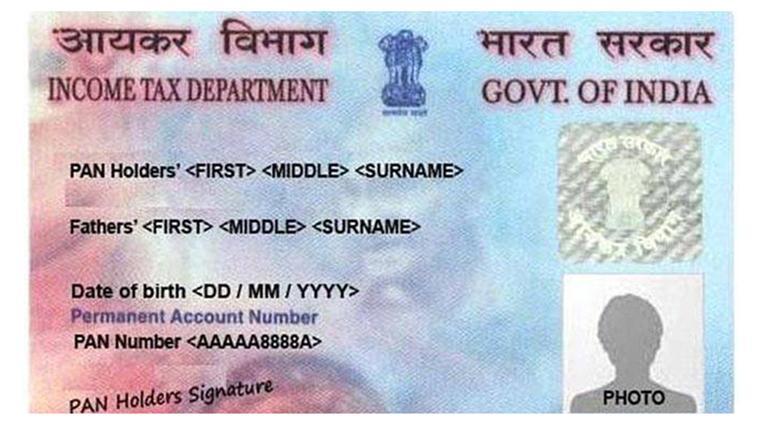

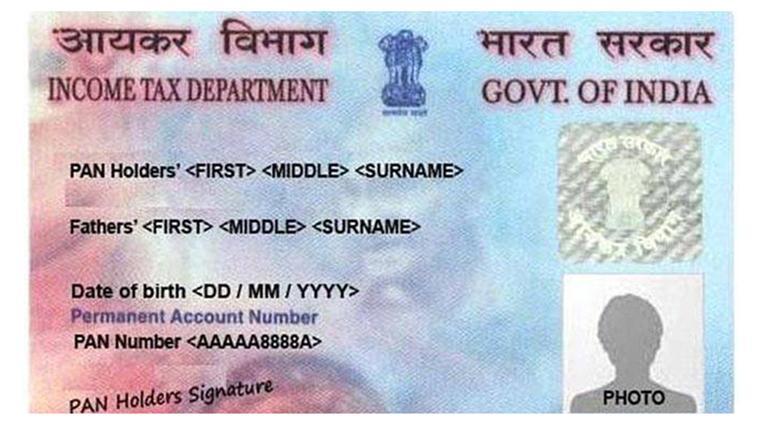

After you send your documents to the agency office, you can expect to receive the PAN at the address specified by you within 15 working days. The verification of the PAN application is done at the offices of the PAN issuing agencies and finally, the unique 10-digit PAN is received from the Income Tax department’s server. When you receive your PAN card, it should look like the image below:

That's it! Once you have your PAN, your business is ready to start transacting. But wait! You still need two more things before you can start exporting - a Current Account, and an IEC Code.

Pro Tips

Fill the form in CAPITAL LETTERS only.

Do remember to provide the correct address and phone number in your application as this information will be stored against your PAN for future correspondence.

If you have a partnership firm or LLP, get it registered first with the relevant government authorities to be eligible for PAN.

The fourth character in the PAN signifies the type of the PAN holder. For example, F stands for Firm, P for Individual, C for Company etc.

Warnings

The form must be filled in English only. If you're uncomfortable with the language, have a friend, family member, or trusted colleague fill the form out for you using the above guide.

Don’t apply for a PAN if your old card has been stolen, lost or defaced. There is a penalty of Rs. 10,000 for possessing more than one PAN.

On the PAN application form, sign across the photograph partially in the case of the left-top-corner photo. For the right-top-corner photo, sign in the box and not on the photo.

Avoid any overwriting or correction on the face of the application form.