Given the dynamic business world, the visibility of the company's cash flow or successful cash flow management is critical. Inventory financing is a key financial instrument that enables companies to manage their levels of stock and, at the same time, their cash flows by pledging inventory and getting loans or lines of credit based on that. This detailed guide addresses inventory financing, its types, benefits, risks, and the application process for an inventory financing loan.

What is Inventory Financing?

It is asset-based loan financing in which the stocks or inventories are used as collateral security for loans or lines of credit to businesses. Such funding enables the business organization to acquire additional inventory without depletion of cash reserves, which is necessary to meet customer demands and manage seasonal sales variations. Thus, having insight into what inventory financing brings to business operations creates awareness of the reasons for making informed financial decisions toward using this financing tool to benefit one's business.

Types of Inventory Financing

There are several kinds of inventory financing examples that companies can directly take. In brief:

1. Short-Term Loan: A short-term borrowing amount is taken to purchase the business's inventory, and repayment occurs for fixed periods.

2. Inventory Line of Credit: A revolving line of credit, businesses will call on it to finance their inventory purchases. This will give flexibility to the businesses because they can borrow funds and repay as necessary.

3. Warehouse Financing: This is the kind of financing where a loan is granted by a lender to a borrower, and that loan is tied to collateral being kept in a warehouse as inventory.

4. Inventory Factoring: Companies can sell their receivables for immediate cash at discount rates to an outside party so that that cash can be used to purchase inventories.

Why Businesses Need Inventory Financing Loan

In addition to providing adequate cash flow management, introducing new product lines, increasing inventory supplies, and responding to maximum customer demand, inventory finance can also service the business immeasurably. Some of the key reasons why businesses need inventory financing loans are as follows:

- Managing Cash Flow

The steady cash flow will be ensured by providing a mid-month budget for operation expenses like payroll, rent, and utilities. This means that there has been no cash constraint in financing inventories by purchasing stock because of this.

- Updating Product Lines

Companies for which renewing and keeping offerings in competitive conditions is almost a religion must keep renewing line products regularly. Inventory financing is used to put new lines into stock and make the brand new for clients.

- Increasing Inventory Supplies

There usually comes the čas of the year when sales boom and automatic inventory levels tend to rise, meaning that different stocks must be acquired now and then. Inventory financing will fund the purchase of this increased stock.

- Responding to High Customer Demand

It speaks for itself; when the demand by a customer is more than the supply that a business can offer at the time, then it is likely that sales are lost and that there is a disgruntled customer base. Inventory financing for a company is expected to improve the fund availability to acquire extra stocks for prompt fulfilment of customers' orders and a good reputation.

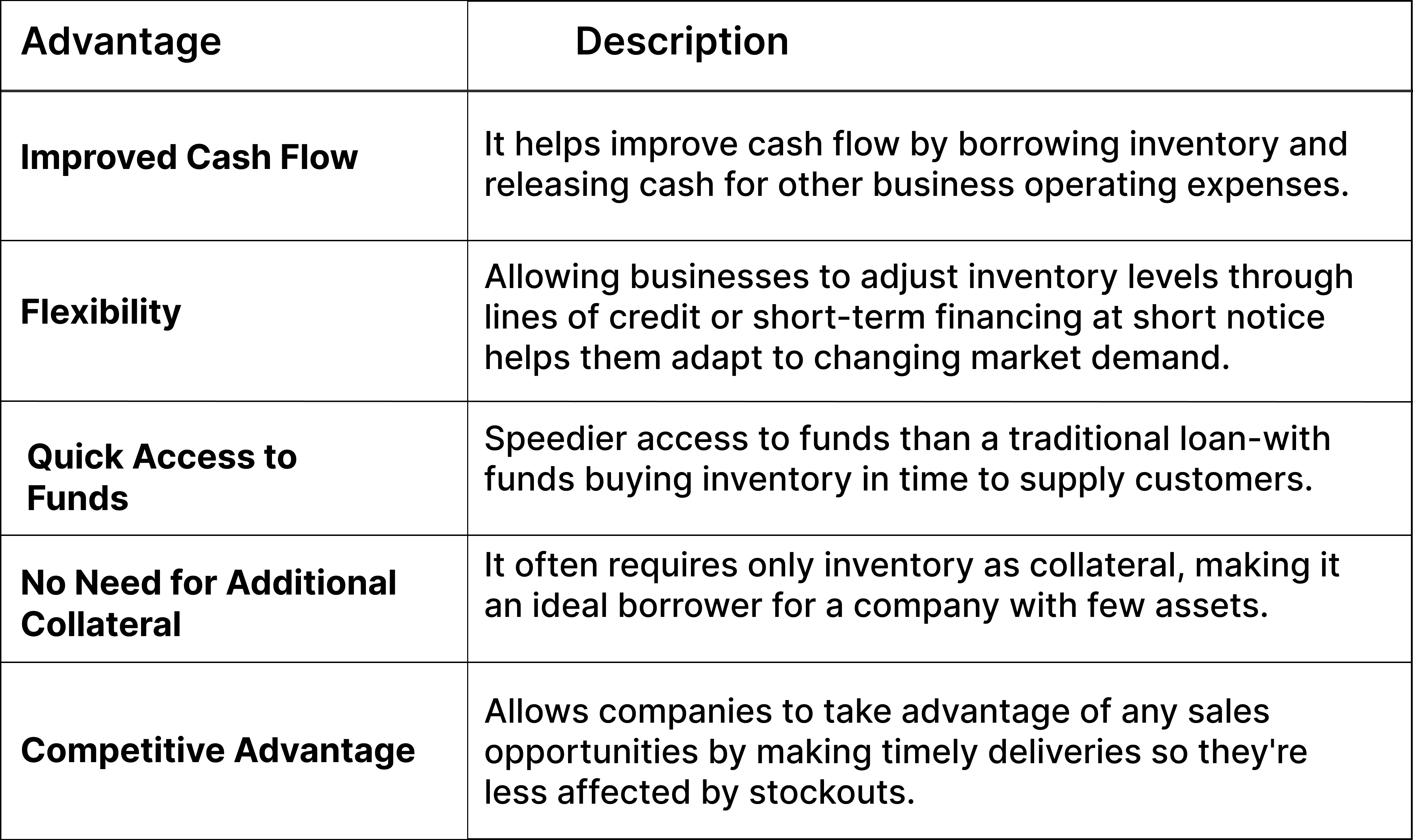

Advantages of Inventory Financing

Generally, inventory financing comes with many benefits for businesses concerning cash flow management while maintaining stock levels that are ideal for sales. Here are some of the principal advantages of financing inventory:

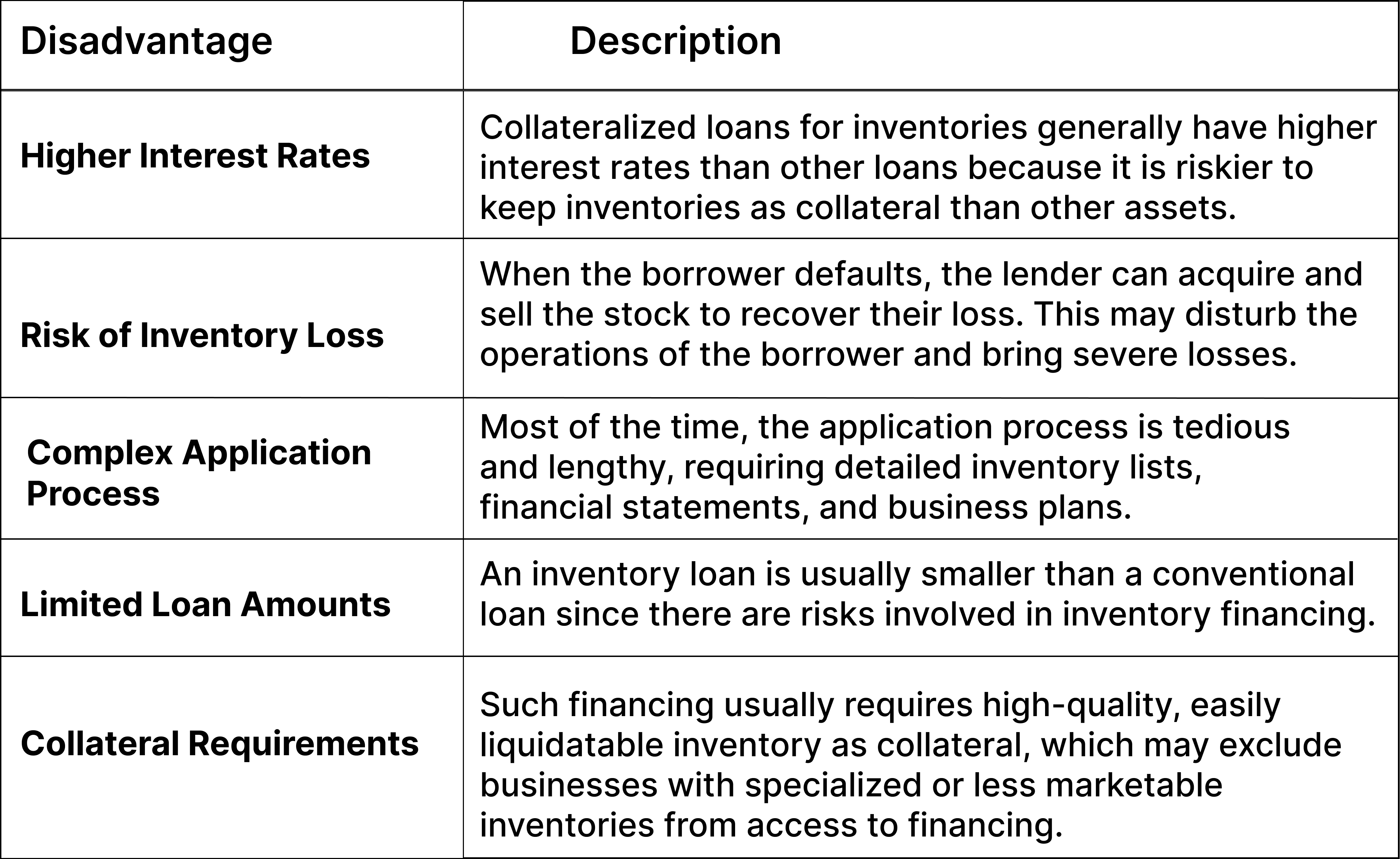

Disadvantages of Inventory Financing

Though beneficial for the business entity, inventory financing is not entirely free of cons. These cons should be taken into account before a business goes for this line of finance:

How to Apply for an Inventory Financing Loan

Applying for inventory financing typically goes through several steps. Businesses should prepare to go through the process and provide the necessary documentation. Outlined below are the basic steps to follow in applying for an inventory financing loan:

1. Evaluate Inventory Value

First, assessing the inventory's value will be better because it will give insight before applying for inventory financing loans. This is usually through an entire inventory audit to determine the gross stock. Knowing the inventory value helps the businesses know what loan amount to seek from the lender while also giving the lender good information about nature inference for loan determination.

2. Choose a Lender

It is vital to be selective when choosing a lender; this would cut down on possible higher-cost loan terms. Research various lenders offering inventory financing and compare their input: interest rates, repayment terms, loan amounts, and the lender's reputation.

3. Prepare Documentation

The paperwork required is that which judges the borrower's creditworthiness and assesses inventory value. Therefore, businesses are required to compile the following documents, among others:

- A complete list of inventories.

- Financial statements, including balance sheets, income statements, cash flow statements, etc.

- A business plan that states the purpose of acquiring the loan and the method by which it would be repaid.

4. Submit Application

After compiling all your documents, you apply for a loan through the lender of your choice. The lender then reviews the application and assesses the borrower's creditworthiness based on the value of the inventory. Ultimatum- The funds will then be used to buy inventory.

Inventory financing is an effective tool for businesses willing to control their cash flows and have definite stock levels they will benefit from. It enables companies to acquire the funds needed for growth and survival through collateralized inventory. Knowing what inventory financing is, the types of inventory financing, the pros and cons, and how to use the facility can all help organizations make informed decisions and apply this financial tool wisely.

Disclaimer: This analysis is for informational purposes only and should not be used to make financial or legal decisions.

Frequently Asked Questions

1. What is the interest rate for inventory financing?

Interest rates on financing for inventory loans vary according to each borrower, based on the borrower's financial history or worthiness and the currency amount involved for the value of the inventory. Still, they are generally higher than traditional loans as lenders consider these cases much riskier.

2. Can I apply for an inventory loan with no credit history?

Some lenders provide inventory financing for businesses without a credit history; however, the conditions differ. Businesses without a credit history are subject to relatively higher interests and rigid approval conditions.

3. Which businesses benefit from inventory financing?

To be specific, small to mid-sized retailers, wholesalers, and manufacturers with the purchase of inventory for future sales gain from inventory financing. It is very beneficial for businesses involved in seasonal demands and unpredictable spikes in customer orders.

4. What are the alternate financing options?

Other financing choices include ordinary bank loans or lines of credit and equipment financing. Businesses must examine and weigh different choices before settling on the one that meets their business and financial requirements.