What is Trade Credit Insurance?

Trade credit insurance is an exclusive insurance policy designed to protect businesses from non-payment of commercial debt.

It is a reimbursement guarantee provided for firms if the buyer fails to pay within the agreed credit period.

Instances of non-payment could arise due to a buyer's bankruptcy, insolvency, delay, default, or any other unexpected geopolitical occurrences. This could hamper the financial health of businesses and even pose a grave risk to their existence.

With trade credit insurance in place, businesses can access most of their outstanding payment amount (75%-95% of the invoice amount) at the specified time through the trade credit insurer. This ensures that their cash flow isn’t interrupted, further enabling them to grow safely.

This type of insurance is also commonly referred to as export credit insurance, debtor insurance, and accounts receivable insurance and is a subset of international trade finance.

As per a report, the global market for Trade Credit Insurance, which attained a value of US$ 10.9 billion in 2021, is further expected to reach US$ 18.1 billion by 2027, representing a CAGR of 9.12%. In India, the industry recorded a premium income of INR 1,395.25 crore in FY 2020-21.

What Types of Risks does it Cover?

Trade credit insurance typically covers two types of risks: –

1. Commercial risk:– This refers to the failure of a buyer to clear the outstanding amount/ invoice due to financial reasons such as bankruptcy, insolvency, protracted default, and more.

2. Political risk:- This refers to non-payment by the buyer due to external events beyond the control of both parties. It could include geopolitical disturbances like war, terrorist attacks, riots, or natural disasters. This risk also covers any action undertaken by the local government, such as import-export restrictions, license cancellation, currency shortage, or any other economic limitations. Political risks are valid only in the case of international buyers.

Types of Trade Credit Insurance Policies

Depending upon the requirements of individual businesses, there are four types of credit risk insurance policies designed for traders.

1. Whole turnover policy:– This policy allows businesses to cover their entire portfolio of buyers. One could choose to apply this coverage for insuring all domestic/international sales or both.

2. Key buyers policy:- Instead of covering the entire portfolio of buyers, businesses could insure only their key accounts or important customers with this policy. These customers are usually the ones with whom a large chunk of trade is conducted and whose non-payment could hinder the growth of the business.

3. Single buyer policy:- This policy provides insurance coverage to businesses for accounts receivables related to only one customer. It is beneficial when a company conducts most of its transactions with a single client.

4. Transactional policy:- This policy provides insurance cover on a transaction-by-transaction basis and is most suited for businesses that witness limited sales or customers.

How does Trade Credit Insurance Work?

1. Assessment of buyer credit worthiness and risk profile:–

Once a business submits all the essential documents, the insurer first calculates the risk by delving deep into factors such as the trade size, claim history, etc. Moreover, information about buyers is gathered through multiple sources, including their financial statements, public records, past shipments, clientele, office visit, etc.

2. Calculation of credit limit:-

Post a thorough risk evaluation, the insurer arrives at a credit limit for each buyer covered under the policy. Once the credit limit is fixed, businesses should offer credit only within the prescribed limit. This is because this would be the maximum amount the insurer would reimburse in case of default. Any amount above this limit won’t be refunded and will be a loss borne by the policyholder.

3. Adjustment of credit limit (if required):–

During the policy term, a business may request and seek additional coverage for trade with any of its buyers. The insurer would first evaluate the risk of increasing the coverage and could either approve or decline the request based on the outcome of the risk analysis. A business can also request a credit limit for a new customer under the existing policy.

4. Making claims:-

Any event of non-payment must be first informed to the insurer, post which the required claim documents need to be submitted. An investigator from the insurance company then verifies the risk. If the claim is liable for compensation, the amount will be paid to the policyholder. However, if the claim is false or not as per the contract, it will be rejected. If the policyholder is unsatisfied with the process, they can raise a dispute in a court of law.

Delving Deep into the Claims Procedure

Documents Required to File Insurance Claim

The policyholder is required to furnish the following documents to file for the trade insurance claim:-

- Claim form, filled and signed

- Identity proof

- FIR report

- Financial books and reports of the business for inspection purposes

- Policyholder’s bank details

- Additional documents (if required)

Timeline to Pay Out a Claim

In most cases, the insurer takes 30 days for claim settlement. However, if a legal dispute is related to the claim, this period might get extended.

Cases where Trade Credit Insurance cannot be Claimed

Trade credit insurance doesn’t cover non-payment issues that arise due to the following reasons:-

- Trade disputes

- Cases of a single buyer or single shipment

- If the loss is covered through a Letter of Credit (LC) or bank guarantees

- Reverse factoring policies

- Currency fluctuations risks

- Commercial credit related to interest or penalty for repayment

Cases where the Claim Can Get Rejected

Late claim filing, i.e., filing the claim after the maximum reporting period.

Non-disclosure of important information while filling out the trade credit insurance form. This information could be related to the history of payment defaults, debtor information, etc.

Claims on risks that are excluded from the policy. These exclusions could include specific territories, certain definitions of goods and payment conditions.

When goods are supplied without receiving advance payment as per the contract.

If a business continues shipping to buyers already overdue on their payments.

Pricing

In most cases, the premium is calculated as a percentage of the company's turnover. Additionally, a limit fee is paid towards each limit applied. Typically, this percentage is lower than 0.5% of the company's turnover. The following factors are taken into consideration while determining the premium:-

- Company's turnover

- Risk profile- includes customer ratings, history of losses or bad debts, etc.

- Industry in which the company operates

- Credit terms

- Any additional risks covered

- Buyers/customers’ location

Eligibility Criteria for Trade Credit Insurance

- Companies involved in the sale of goods and services on credit.

- Large, medium, and small business enterprises.

- Domestic and international suppliers of goods and services.

Terms & Conditions

- Trade credit insurance applies only to short-term accounts, i.e., it covers only the receivables which are due within 12 months.

- This insurance cover isn’t available for banks and financial institutions.

Key Advantages of Trade Credit Insurance

1. Protection against bad debts:–

If a customer cannot pay the amount owed, trade credit insurance pays out a percentage of it (usually 75-95%). In this way, fear of bad debts is eliminated, and focus can be maintained on business growth.

2. Ensures business continuity:-

Since businesses are guaranteed their payments on time, cash flow is continually maintained irrespective of the source.

3. Sales growth:–

When the receivables are insured and the non-payment risks are covered, a company can safely extend more credit and sell more to existing customers. As per a report, trade credit insurance allows a company to grow sales by up to 20%.

4. New markets:–

Since the trade credit insurer effectively manages credit terms, businesses can confidently leap and grow their business in new or even riskier markets. This can prove to be a significant competitive advantage and help in revenue growth for exporters.

5. Improves access to funding:–

Bankers, shareholders, and other financial partners place more trust in insured companies, as the security of their cash flow is guaranteed. Banks, in particular, lend more capital against insured receivables, and that too at reduced rates. As per a report, banks lend up to 80% more on insured receivables. Therefore, with trade credit insurance, businesses can easily access funds and secure more favorable financing terms.

Disadvantages of Trade Credit Insurance

- The cost associated with trade credit insurance is an additional cost that needs to be incurred by the business. Moreover, depending upon the nature of the insured, these costs can vary and even prove to be high in certain cases.

- Not all businesses are insurable with trade credit insurance. For instance, accounts that involve high credit risk are usually not covered. Moreover, non-payment scenarios such as customer disputes, quality issues with goods and services, etc. are also not covered.

- Trade credit insurance does not offer 100% risk coverage. Since only 75-85% of accounts receivable in a transaction are insured, the policyholder will need to incur a part of the loss.

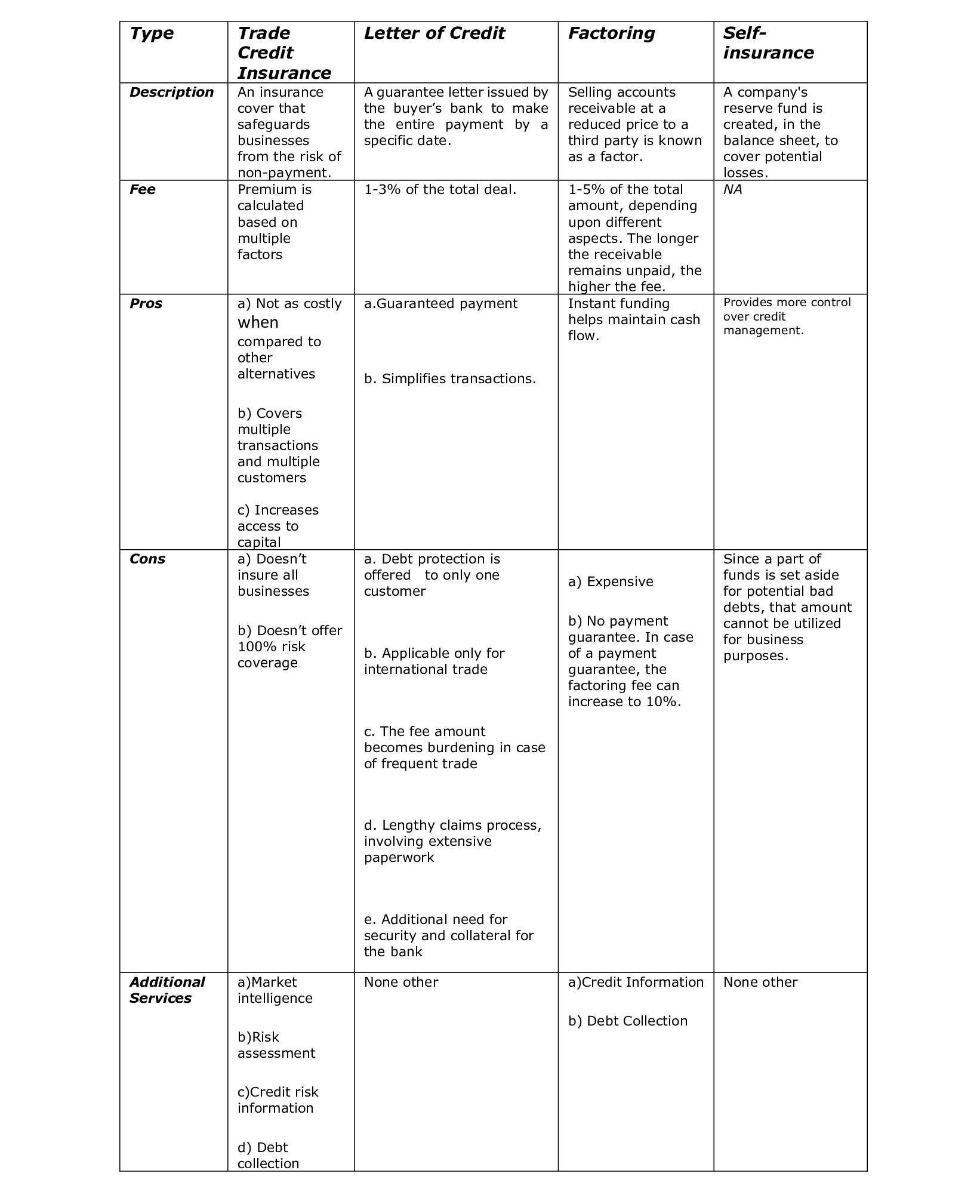

Trade Credit Insurance Vs. Letter of Credit Vs. Factoring Vs. Self-Insurance

The Role of Trade Credit Insurance during the Covid-19 Crisis

The covid-19 pandemic has dramatically altered the dynamics of global trade. At its onset, the financial balance sheets of multiple businesses went off-balance, and the rising risk of non-payment made it difficult for many to extend credit. Moreover, many leading companies filed for bankruptcy, and the challenge of payment recovery loomed largely.

Facing such high tides of uncertainty, many businesses turned to trade credit insurance to cover their trading risks and continue business with confidence. In India, the demand for trade credit insurance shot up 30% Y-o-Y in April-June 2021. It played a crucial role in mitigating the risk when the global supply chains were disrupted. Since then, there has been a consistent rise in the adoption of trade credit insurance globally.

FAQs

1. What trade credit insurance is not?

Trade credit insurance is not a replacement for a company's credit practices. It only supplements them and also enhances the job of a credit professional.

2. What does it not cover?

Only the commercial and political risks are covered under trade credit insurance. Those outstanding debts which fall outside the direct trade between two businesses are not covered.

3. Who sells trade credit insurance?

Trade credit insurance policies can be purchased from insurance companies and various independent trade credit insurers.

4. Which companies can buy trade credit insurance?

Businesses of all sizes that offer their buyers credit can purchase trade credit insurance. These could include MSMEs, big corporations, and international businesses.

5. Can trade insurance policies be customized?

Yes, trade insurance policies can be tailored to suit businesses' specific requirements and nature. The standard policies are also available and are particularly useful for MSMEs.

6. Can domestic buyers be insured through trade credit insurance?

Since trade credit insurance covers both international and domestic trade, the local/ domestic buyers can also be covered.