What is Export Credit Insurance?

Export credit insurance in India is designed to protect the receivables of an exporter. It means that the insurance tool provides an assurance to the exporter about receiving the amount due from the foreign customer. The insurance pays a portion of the assured value in case the customer or the foreign bank is not able to pay it due to political, commercial, or any other reasons.

Export credit insurance is provided by India’s ECGC. The full form of ECGC stands for Export Credit Guarantee Corporation Limited (ECGC), it is an open cover to credit insurance & a mandatory requirement for it.

The ECGC policy was formed in 1957 by the Government of India to promote trade in the country by providing credit risk insurance and related services to exporters.

The Export Credit Guarantee scheme (ECGC) is under the auspices of the Ministry of Commerce and has a board comprising members from the RBI, the government, and people from banking, export and insurance sectors.

Also Read : What is Trade Finance and How Does it Works?

What Export Credit Insurance does for exporters?

Let us look at some of the advantages of export credit insurance, reasons to - why this is an indispensable asset for anybody shipping goods overseas:

Export risk and Insurance is covered in the export credit insurance policy.

With a credit insurance policy in place, you don’t have to worry about the timely recovery of sales revenue. Credit insurance saves you the time you might spend on credit risk management and assessment, freeing you to focus on business development and growth.

It also enables you to be flexible with your credit period and/or your credit line, increasing them if necessary.

Giving buyers greater flexibility with credit will encourage new buyers to do business with you and existing buyers to buy more from you. Thus, export credit can help you increase your sales.

How does Export Credit Insurance work?

As an exporter, it is essential to get yourself export credit insurance for a variety of reasons. Here is a simplified version of how things work in the process:

With the backup provided by credit insurance, you can also explore opportunities in new markets with confidence. Credit insurance often covers up to 95% of the invoice you raise, allowing you to take more chances and tackle new markets without worrying unduly about losses.

Export credit insurance companies also provide additional benefits like guidance and information on debts and customers, and support in debt recovery.

Having credit insurance can also boost your chances of arranging for export finance. When you try to finance your export business, if the lender is assured that your invoices are covered by credit insurance, arranging for finance becomes easier because of reduced risk.

> Also Read: Choosing and registering the right entity for your export business

Advantages & Disadvantages of Export Credit Insurance

Advantages

- Expand to new markets

- Protect Accounts

- Security of Cash flow

- Tax Benefits

- Minimise bad debts

Disadvantages

- Limits certain actions

- Not available for high-risk accounts

- Possibility of default and bad faith

- It does not cover non-payment situations

What’s ECGC's Export Credit Insurance scheme & its role in the export business?

The main ECGC functions are multifaceted, albeit within the scope of export credit risk management.

Its primary role is to provide a variety of risk insurance products that cover losses and bad debts on exports.

The ECGC also offers export credit insurance cover to banks and financial institutions so that they can provide trade-risk coverage to exporters.

The Corporation also offers overseas investment insurance to Indian companies that are entering into international joint ventures, in the form of equity or loans.

The ECGC policy also provides guidance on export-related activities to exporters, including credit rating-based information on different countries.

The ECGC cover can also help exporters arrange for export finance from banks (i.e Bank Export Credit) and financial institutions.

Finally, it assists exporters with debt recovery and checking the creditworthiness of overseas customers.

Also, there is no GST payable in insurance premium.

How much does Export Credit Insurance cost?

Generally, export credit insurance cost is calculated as a percentage of overall invoices/accounts receivable. Depending on the terms of the transaction, and the country in which one operates this may vary.

How does ECGC's Export Credit Insurance help Indian Exporters?

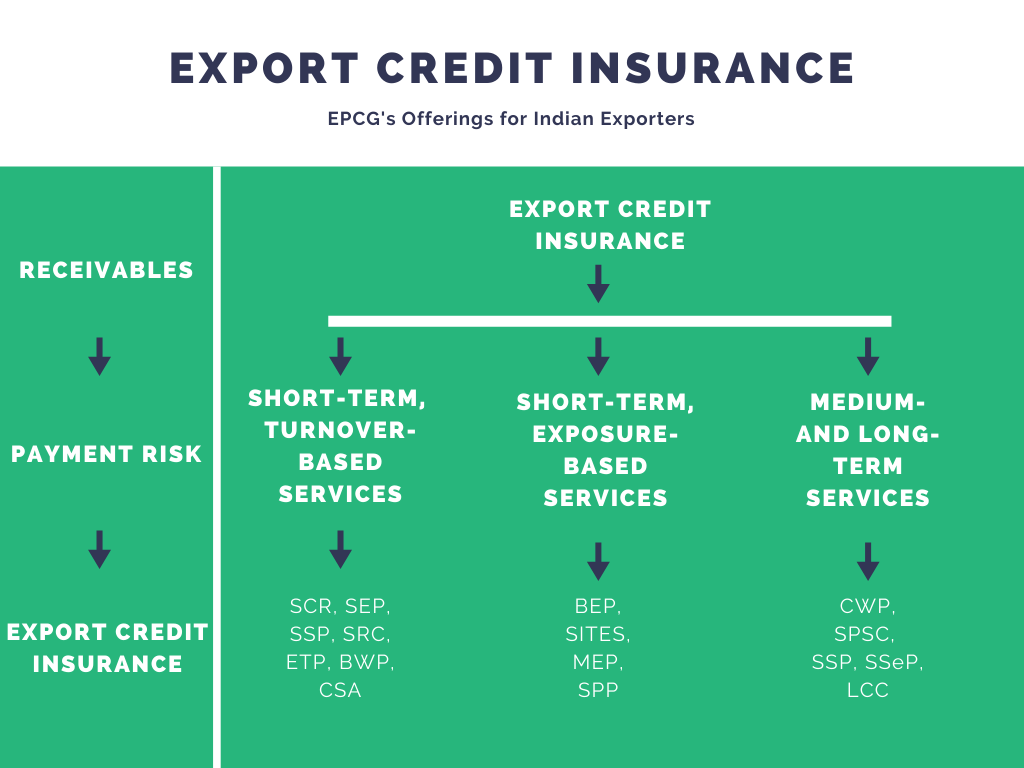

The ECGC policy provides a bouquet of services under the credit risk domain. Below are some of the key ECGC products and services available to Indian exporters that one can get from ECGC policy:

Short-term, turnover-based services

These are the types of payments terms in Short-term (turnover-based) period for Indian Exporters:

Shipments Comprehensive Risks Policy (SCR) : SCR is a 12-month policy available to exporters with a turnover of over Rs. 500 crores.

Small Exporters Policy (SEP) : SEP is available for exporters with a turnover of Rs. 5 crore or below and has a maximum risk coverage that costs below Rs. 2 crores.

Specific Shipment Policy (SSP) : SSP is valid for shipments made within the policy period and for up to 80% of the shipment value.

Services Policy (SRC) : SRC is for single, long-term services contracts. It is suited for Indian companies who agree with foreign principals to provide technical or professional services.

Export Turnover Policy (ETP) : ETP is for large exporters who contribute not less than Rs. 20 lakhs in annual premium.

Exports (Specific Buyers) Policy (BWP) : BWP provides the same coverage as SCRP, ETP, etc. against shipment sent to a specific buyer.

Consignment Exports Policy (Stockholding Agent) (CSA) : CSA covers shipments sent by the exporter to their overseas agents on a consignment export basis.

> Also Read: APEDA's Online Registration Process & Schemes for Agricultural Exports

Short-term, exposure-based services

These are the payment terms in Short-term (Exposure-based) period in exports:

Buyer Exposure Policy (BEP) : BEP is against many shipments sent to a specific buyer with a simplified process and rationalized premium.

IT-Enabled Services Policy Single Customer (SITES) : SITES is available against billings made to a single customer for IT services rendered.

Micro Exporter Policy (MEP) : MEP is an exposure policy for exporters with a turnover that costs below Rs. 100 lakh and offers up to 90% cover.

Software Project Policy (SPP) : SPP is for exporters of software and related services where payment will be received in foreign exchange.

Medium- and long-term services

These are the best mode of export payments for medium & long term period services:

Construction Works Policy (CWP) : CWP is designed for an Indian contractor who is carrying out an overseas civil construction contract.

Specific Policy for Supply Contract (SPSC) : SPSC is meant for exporters who have a credit period of fewer than 180 days and want continuing insurance on the shipments.

Specific Shipment Policy (SSP) : SSP like the namesake policy offered for short terms, is intended for exporters who have agreed to supply capital goods to overseas buyers on deferred terms of payment.

Specific Services Policy (SSeP) : SSeP is designed to cover payment risk emerging out of various overseas service contracts like technical requirements, professional hiring, leasing, etc.

Letter of Credit Confirmation (LCC) : LCC covers Indian banks against a foreign bank’s default on lines of credit.

Apart from the above, the ECGC also provides services like export factoring facilities for MSMEs, insurance cover for buyer’s credit and line of credit, overseas investment insurance, customer-specific covers, and the setting up of a national export insurance account to facilitate medium- and long-term exports.

It also offers a wide range of credit risk insurance products for exporters’ banks.

> Also Read: How to calculate financial projections for a business plan

Export Credit Insurance vs Letter of Credit

Both of these tools help in reducing the payment risk and assure payment on time. Export credit insurance is used in international trade transactions to safeguard accounts receivable and secure them.

In addition, the cost for any default payment or even bankruptcy is covered by the insurer. This insurance is taken by the supplier and the buyer consent is not required for the same.

Whereas a Letter of Credit is taken by the buyer, and this letter is issued by the buyer’s bank on his behalf. Further, you need the buyer's consent for every trade proceeding under a letter of credit. For any new trade transaction, a letter of credit is the best option.

> Also Read: Types of Letter of Credit

Pro-Tips

ECGC premium is a guaranteed practitioner’s guide for export payment, so always keep adequate in your ECGC account to cover your shipments for the next month/quarter.

Use the ECGC database to do a background check on your prospective buyers and to see whether exporters/the ECGC have had an adverse experience with them in the past.

You should ensure that the maximum liability of your policy is enough to meet all your outstanding dues at any given point of time, as no GST is applicable on EPCG premium.

Warnings

Just like with any insurance product, a delay in filing claims can lead to rejection of your credit insurance claim.

Don’t make new shipments to a defaulting buyer without the approval of the ECGC.

Don’t fail to intimate the ECGC about bills that are overdue beyond 60 days, at least once in a month.

Also Read: